30h4.site Tools

Tools

Schedule Of Mortgage Payments

You can view a schedule of yearly or monthly payments and see how much of your payments go toward the principal and interest. Your amortization summary. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. It's a chart that shows you how much of each payment will go toward interest and principal—until you pay off the house! Amortization Period vs. Mortgage Term. One time extra payments refer to additional payments that are made to the principal balance of. Show amortization table. Early Loan Repayment: A Little Goes a Long Way One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. An amortization schedule is a table that shows homeowners how much money they will pay in principal (starting amount of the loan) and in interest over time. It. Your amortization schedule will show you how much of your monthly mortgage payments you spend toward principal and interest. Monthly principal & interest. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments. You can view a schedule of yearly or monthly payments and see how much of your payments go toward the principal and interest. Your amortization summary. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. It's a chart that shows you how much of each payment will go toward interest and principal—until you pay off the house! Amortization Period vs. Mortgage Term. One time extra payments refer to additional payments that are made to the principal balance of. Show amortization table. Early Loan Repayment: A Little Goes a Long Way One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. An amortization schedule is a table that shows homeowners how much money they will pay in principal (starting amount of the loan) and in interest over time. It. Your amortization schedule will show you how much of your monthly mortgage payments you spend toward principal and interest. Monthly principal & interest. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments.

Use this home loan calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time It's a table that lists how many monthly mortgage payments. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Calculate farm or land loan payments using monthly, quarterly, semiannual or annual payment schedules. Your Inputs. Loan amount. Payment schedule. Term. An amortization schedule is a table that shows you how much of a mortgage payment is applied to the loan balance, and how much to interest, for every payment. It's the process that determines how much of your monthly mortgage payment goes towards the principal of your loan and how much covers the interest. When you. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Home Loan Amortization Table* ; 60 (5 years in), $, $, $ ; (10 years in), $, $, $ Use this calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your estimated. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. An amortization schedule for a loan is a list of estimated monthly payments. At the top, you'll see the total of all payments. For each payment, you'll see the. The amortization schedule shows how your monthly mortgage payment is split between interest and principal over the duration of the loan. Most of your payment. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. A mortgage loan is typically a self-amortizing loan, which means both principal and interest will be fully paid off when you make the last payment on the. When you make payments on your loan, the amortization schedule is set up to ensure each payment covers the interest and some portion of the principal amount. Create an amortization schedule payment table for loans, car loans and mortgages. Enter loan amount, interest rate, number of payments and payment frequency. Amortization Schedule – A table of all payments for the entire loan term showing each payment broken out into interest, principal, and remaining loan balance.

Crypto Mining On A Laptop

Bitcoin mining is the process by which transactions are officially entered on the blockchain. It is also the way new bitcoins are launched into circulation. Nvidia RTX Ti Laptop can reach MH/s hashrate and 75 W power consumption for mining ETH (Ethash). Find out more hashrate, consumption, difficulty. A laptop: 2–5$ monthly, an average gaming PC: 20–40$, a good one, with strong GPU: 60–$ monthly. This comes with a downside though - it's made the space competitive. The average hobby miner can't compete with crypto mining farms and the start-up costs for. Mining cryptocurrencies on a laptop is generally not recommended due to the high energy consumption and potential damage to your hardware. In this guide, we will walk you through the process of setting up a mining pool on your laptop and making money from it. Some popular Bitcoin and crypto mining software programs include CGMiner, BFGMiner, EasyMiner, Awesome Miner, and MultiMiner. Each program has its own unique. A mining rig is basically a computer with extra graphics cards (or GPUs). Mining rigs are often not built with standard cases since there is not enough room to. r/laptopmining: Community made for people who are interested in crypto mining with laptops to share their own tips&tricks or learn from others. Bitcoin mining is the process by which transactions are officially entered on the blockchain. It is also the way new bitcoins are launched into circulation. Nvidia RTX Ti Laptop can reach MH/s hashrate and 75 W power consumption for mining ETH (Ethash). Find out more hashrate, consumption, difficulty. A laptop: 2–5$ monthly, an average gaming PC: 20–40$, a good one, with strong GPU: 60–$ monthly. This comes with a downside though - it's made the space competitive. The average hobby miner can't compete with crypto mining farms and the start-up costs for. Mining cryptocurrencies on a laptop is generally not recommended due to the high energy consumption and potential damage to your hardware. In this guide, we will walk you through the process of setting up a mining pool on your laptop and making money from it. Some popular Bitcoin and crypto mining software programs include CGMiner, BFGMiner, EasyMiner, Awesome Miner, and MultiMiner. Each program has its own unique. A mining rig is basically a computer with extra graphics cards (or GPUs). Mining rigs are often not built with standard cases since there is not enough room to. r/laptopmining: Community made for people who are interested in crypto mining with laptops to share their own tips&tricks or learn from others.

Mining cryptocurrencies on a laptop can be challenging due to hardware limitations. Monero stands out as it can be mined using standard CPUs, making it. MultiMiner is a GUI-based software program that was created as a part of the Windows 10 Bitcoin mining platform. It can be used with macOS or Linux as well. Laptops are okay at managing the heat generated from moderate loads. You'll cook the insides of your laptop mining if you're not careful. Cudo Miner is a crypto mining platform that allows automated mining, reducing manual configuration and intervention by up to 95% without losing profitability. Bitcoin Merch Mini Mining Laptop: A specialized device for mining efficiency. Consuming only 30 Watts, it's ideal for Monero (XMR) mining with preinstalled. Bitcoin Merch Mini Mining Laptop: A specialized device for mining efficiency. Consuming only 30 Watts, it's ideal for Monero (XMR) mining with preinstalled. sometimes it's super profitable super smart. and other times you're just wasting electricity time and pc power. when you're mining you're basically running your. It is the best way to start mining cryptos and earn some extra money! But there are some pros and cons of mining cryptocurrency using it, and this article will. We combine the processing power of thousands of computers to run complex distributed cryptocurrency computations. Mining cryptocurrency is hard. We've made. NiceHash allows you to earn Bitcoin when you provide idle computing power of your CPU or GPU. To start selling your idle computing power you must use one of. This guide is designed for people mining crypto with laptops, the methodology and software can also be used to mine on Desktop computers under Windows, Linux. Bitcoin Merch Mini Mining Laptop: This is not just any laptop; it's a mining powerhouse designed by 30h4.site Consuming only 30 Watts, it's a beacon. How to Make A Million Dollars in Bitcoin with a $ Laptop? Almost any device capable of making simple calculations may contribute to crypto mining pool. At Bitcoins peak I would be sitting near $–$! if you had multiple laptops or even computers running this, you can easily generate over k a year. Cryptocurrency mining software is used to create new cryptocurrencies through complex mathematical problem-solving and add components to an existing blockchain. This guide explains how to quickly evaluate a computer, server or laptop to determine if it can make money mining cryptocurrency. Results · New NerdMiner V2 78KH/s T-Display S3 Bitcoin Solo Lottery Miner Win BTC with Low Power Consumption - WiFi Connection, and USB-C Power · Solosatoshi. Recommended mining devices ; Radeon RX XT · $ $ ; GeForce RTX · $ $ ; GeForce RTX Ti · $ $ Bitcoin mining is the process of creating new Bitcoin by solving complicated math problems or puzzles as quickly as possible. The first miner to solve the. NVIDIA GeForce RTX Laptop GPU can generate more than USD monthly income with a H/s hashrate on the BTG - ZHash (GMiner) algorithm. · Select a.

Best Cpa Prep Courses

Yaeger CPA Review has been a beacon for CPA candidates seeking not just to pass the exam but to excel. Offering over hours of streaming video lectures. Pass the exam with CPA exam prep that helps you make better decisions as you study. Real-time analytics, advanced study tools, and expertly authored materials. The #1 Solution for the CPA Exam. Becker has your Back! Exam Day Ready SM students save time and money, and pass 94% of their CPA Exams. Becker CPA review has the highest published pass rate at 95% followed by Wiley CPA and UWorld Roger CPA review at 92% and 91%, respectively. All CPA review. Prep for your CPA exam with our engaging courses, intensive bootcamps, and personalized tutoring. Interactive videos, comprehensive guides, and realistic. We make it easy and affordable for you to switch to the best exam prep course available. We want you to succeed – earn your credential faster and easier with. Reddit users often mention Becker, Roger (UWorld), Surgent, Gleim, and Wiley as top CPA review courses. Each has its strengths, and the best choice often. Which CPA Review course has the best pass rate? UWorld CPA Review has a 94% pass rate, the highest among all CPA courses. How to choose the right CPA Review. UWorld offers the best CPA review courses with quality practice questions and innovative learning tools such as digital flashcards. Yaeger CPA Review has been a beacon for CPA candidates seeking not just to pass the exam but to excel. Offering over hours of streaming video lectures. Pass the exam with CPA exam prep that helps you make better decisions as you study. Real-time analytics, advanced study tools, and expertly authored materials. The #1 Solution for the CPA Exam. Becker has your Back! Exam Day Ready SM students save time and money, and pass 94% of their CPA Exams. Becker CPA review has the highest published pass rate at 95% followed by Wiley CPA and UWorld Roger CPA review at 92% and 91%, respectively. All CPA review. Prep for your CPA exam with our engaging courses, intensive bootcamps, and personalized tutoring. Interactive videos, comprehensive guides, and realistic. We make it easy and affordable for you to switch to the best exam prep course available. We want you to succeed – earn your credential faster and easier with. Reddit users often mention Becker, Roger (UWorld), Surgent, Gleim, and Wiley as top CPA review courses. Each has its strengths, and the best choice often. Which CPA Review course has the best pass rate? UWorld CPA Review has a 94% pass rate, the highest among all CPA courses. How to choose the right CPA Review. UWorld offers the best CPA review courses with quality practice questions and innovative learning tools such as digital flashcards.

Becker CPA Exam Review offers CPA prep courses that are the gold standards in the exam prep market. That's why we've named Becker as our #1 rated CPA prep. Gleim CPA Review and Becker CPA Review both provide all of the information you need to know and present it in simple, digestible formats. Becker specializes in. How Hard Is The CPA Exam? (EXPERT GUIDE) · Best CPA Review Course | Top 5 Prep Options (MUST WATCH) · CPA Exam Review: Roger vs Becker vs Gleim vs. Explore this list of CPA exam review course programs, including MNCPA partner Surgent CPA Review. CPA review course discounts are available to MNCPA. 6 Best CPA Exam Prep Courses · American Institute of CPAs · Becker · Gleim · NINJA · Surgent Account & Financial Education · UWorld. Formerly known as Efficient. Best CPA Exam Cram Courses and Final Review Guides · 30h4.site CPA Review Course: Rated the #1 Best CPA Review Course of · 30h4.sitet CPA Prep Course: Best. CPA Exam Review Courses UWorld is the best CPA review when you compare value, features, support, and quality of material. All of UWorld's CPA prep course. Becker CPA Review Becker CPA Review is the most expensive, most popular, and most searched company because it is the biggest name in CPA Exam prep. The four. The best-known CPA review course is undoubtedly Becker CPA Review. It's highly recommended for its large bank of relevant practice questions, well-written. CPA Prep / Review Courses · Becker Professional Education · Gleim CPA Review · Roger CPA Review · Surgent CPA Review · Yaeger CPA Review. GLEIM HAS HELPED CPA CANDIDATES PASS OVER 1 MILLION CPA EXAMS. And that number is rising quickly thanks to Gleim CPA's significant advantages over the. Review Courses ; NJCPA Member Discount, Premier: $1, Elite-Unlimited: $2, Elite-Unlimited+: $2,, Essential: $1, Premier: $1, Ultimate: $2, The 5 Best CPA Review Courses in Becker CPA Review, UWorld Roger CPA Review, Surgent CPA Review, Gleim CPA Review, and NINJA CPA Review. There are several highly-regarded CPA Review courses. Some of the top options include Becker CPA Review, Surgent CPA Review, Wiley CPA Review Course, and Gleim. Boost Your CPA Exam Success with the Best CPA Review Courses · Best Overall: Becker CPA Review · Runner-Up, Best Overall: UWorld Roger CPA Review · Best. Becker CPA Review This CPA prep company is officially endorsed by the Big 4 accounting firms, which is one of many reasons why we consider it the best study. CPA Mega Test Bank. The best-selling CPA course supplement. Learn More. Varsity Tutors can help you study for it with a CPA prep course. If you've ever spent time looking up things like "CPA help near me" online, then you probably. Becker CPA Review vs. UWorld CPA Review vs. Surgent CPA Review vs. Gleim CPA Review vs. NINJA CPA Review: Finding the Best CPA Review Course (for you). According to Ahrefs, “Becker CPA Review” is the most popular search and the most mentioned course on CPA Reddit, according to Google. Investopedia also rated.

Auto Loans For First Time Car Buyers

A First-Time Car Buyer Program You Can Count On! · Low, Fixed-Rate Financing. Your monthly car payment will be affordable and consistent, even if the market. First-time auto purchase? We got you. · Pre-approval available for extra bargaining power at the dealership · No payments for up to 45 days · No prepayment. 5 Options for a First-time Car Buyer Loan ; Used car loan aggregators · MyAutoloan · MyAutoloan - Used car purchase loan · % · $8,$, ; New car. First-Time Buyer Program · Up to % financing of purchase price including tax, license, and warranty² · Loan amounts up to $25, · Terms up to 72 months. You want to buy a car but have limited or no credit history. We offer first time auto buyers who don't have any car buying experience, a loan that is. Borrow up to $30, · Choose a flexible term, up to 60 months, for a budget-friendly payment. · Get financing for up to % of the car's value. · Automatically. First-Time Auto Buyer · Down Payment only 5% · Maximum 60 month term · Maximum $25, loan amount · No Cosigner Required · No Credit History Necessary. The maximum amount you can borrow with a First-Time Car Buyer Loan is $20, The maximum term length is up to 72 months, and the minimum cash down payment is. Our First Time Auto Buyer Loan is made for those with no qualifying auto credit, no derogatory credit, and no available co-borrower, and applies to both new. A First-Time Car Buyer Program You Can Count On! · Low, Fixed-Rate Financing. Your monthly car payment will be affordable and consistent, even if the market. First-time auto purchase? We got you. · Pre-approval available for extra bargaining power at the dealership · No payments for up to 45 days · No prepayment. 5 Options for a First-time Car Buyer Loan ; Used car loan aggregators · MyAutoloan · MyAutoloan - Used car purchase loan · % · $8,$, ; New car. First-Time Buyer Program · Up to % financing of purchase price including tax, license, and warranty² · Loan amounts up to $25, · Terms up to 72 months. You want to buy a car but have limited or no credit history. We offer first time auto buyers who don't have any car buying experience, a loan that is. Borrow up to $30, · Choose a flexible term, up to 60 months, for a budget-friendly payment. · Get financing for up to % of the car's value. · Automatically. First-Time Auto Buyer · Down Payment only 5% · Maximum 60 month term · Maximum $25, loan amount · No Cosigner Required · No Credit History Necessary. The maximum amount you can borrow with a First-Time Car Buyer Loan is $20, The maximum term length is up to 72 months, and the minimum cash down payment is. Our First Time Auto Buyer Loan is made for those with no qualifying auto credit, no derogatory credit, and no available co-borrower, and applies to both new.

Our special first-time car buyer loan program is designed to help new-to-credit borrowers get an auto loan and successfully repay it. We offer competitive rates. If you belong to a credit union, that should be your first stop. After that, consider your bank or online auto lenders. And don't accept financing at the. Looking to buy your first car? We're here to help you step by step with our expertise and our First Time Auto Loan. Buying your first car is a huge. Eligibility · Driver's license · Proof of full-coverage insurance · 5% cash down payment of total purchase price (new vehicles rebate may be used as down) + · 6. Best for Most Borrowers: AUTOPAY · Best From a Big Bank: Chase Auto · Best for Military Members: Navy Federal · Best for Online Experience: Carvana · Best for. Five tips for buying a car · Get pre-approved. Getting pre-approved for an auto loan will help with setting your budget before you shop. · Determine your 'must-. Try DCU or Navy Federal if you qualify, they have some of the best rates. There's usually limits on how old the car can be and the mileage. Green-light your first car purchase · Borrow up to $20, · Terms available up to 60 months · Vehicle must be or newer and have fewer than , miles. Your first auto loan. If you meet the qualifications of our first-time auto buyer program, you'll score a %* APR along with $50 to fill up your tank. For those members who have never purchased a vehicle or motorcycle, TFCU offers the First-Time Buyer Auto/Motorcycle Loan. This is a way for members with. Purchasing your first vehicle is an exciting time & Credit Union of Denver is here to help you through the auto loan & first-time car buying process. First-time car buyers don't always have the best (or any) credit, but that doesn't mean you shouldn't get a good rate. After 12 months of on-time payments, you. FIRST-TIME AUTO-BUYER PROGRAM · Age to qualify · No cosigner required · Terms up to 60 months · Loan amounts from $5, - $20, · Up to 90% financing. Just starting out? Get rolling with our First Time Car Buyer program If you are new to vehicle financing, it's easy to feel overwhelmed. Rest assured, we are. Have a steady, full-time job. · Apply a down payment of at least 10% of the vehicle price. · Provide proof of income and length of employment. · Give a list of 3. Avoid the heartbreak of falling in love with a car you're not able to afford. Find how much car you can afford before you start shopping by getting pre-. Our 1st Time Auto Buyer Program sets you up for success when it comes to financing your first car and your future vehicle purchases. The loan has manageable. Our First-Time Auto Buyer Program can give you the opportunity to enjoy a vehicle of your own. If you have little, to no credit, and are ready to embark on the. The general rule of thumb is having a 20% down payment—plus a little extra if they can. That means if a vehicle is $20,, you should have $4, ready to put. It's Easy to Qualify for the First-Time Buyer Loan · Must be at least 18 years old · Must be employed for a minimum of one (1) year · Proof of gross monthly income.

How To Get Paid Filling Out Surveys

Connect, Share and Earn · Complete Your Profiles: Many survey platforms use your profile information to match you with relevant surveys. · Stay. Online reviews of companies, such as those offered by Survey Police, or talking to people who have worked for them is a good place to start. Payment can come in. Get started: Members earn points by signing up, confirming their email address and completing their general profile and their category-specific profiles. In addition to completing online surveys to make extra cash, many InboxDollars members have other side hustles like flipping thrift store finds on eBay. Receive a survey based on your profile. Follow your interest. Get paid to take surveys online—instant payment. Refer and earn. Get ample rewards. Offers on. Over the past 10 years, Swagbucks has paid out over $ million dollars to its members for taking online surveys and completing other related online activities. You may have heard us mention Qmee* for its browser add-on that pays you to Google. It's now better known for its surveys for cash, and you can take part online. Completing paid surveys online can be a good way to make a bit of extra cash here and there, provided you have the time. Individuals who visit these sites. Corporations Will Pay You For Your Opinion. Fill Out Surveys. Get Paid. Simple as That. Product details. Release Date, Date first listed on Amazon, May Connect, Share and Earn · Complete Your Profiles: Many survey platforms use your profile information to match you with relevant surveys. · Stay. Online reviews of companies, such as those offered by Survey Police, or talking to people who have worked for them is a good place to start. Payment can come in. Get started: Members earn points by signing up, confirming their email address and completing their general profile and their category-specific profiles. In addition to completing online surveys to make extra cash, many InboxDollars members have other side hustles like flipping thrift store finds on eBay. Receive a survey based on your profile. Follow your interest. Get paid to take surveys online—instant payment. Refer and earn. Get ample rewards. Offers on. Over the past 10 years, Swagbucks has paid out over $ million dollars to its members for taking online surveys and completing other related online activities. You may have heard us mention Qmee* for its browser add-on that pays you to Google. It's now better known for its surveys for cash, and you can take part online. Completing paid surveys online can be a good way to make a bit of extra cash here and there, provided you have the time. Individuals who visit these sites. Corporations Will Pay You For Your Opinion. Fill Out Surveys. Get Paid. Simple as That. Product details. Release Date, Date first listed on Amazon, May

Find paid online surveys and get money to your PayPal account for each qualified survey you complete. Apply to a project that interests you from the list. One of the most flexible options for making extra money online is MyLead. This platform allows users to earn money by filling out forms and promoting affiliate. Get paid by completing surveys online with Surveyz. Do the surveys in the comfort of your own home or anywhere. Paid surveys that pay more. Answering questions in a certain way is not required to receive a credit and discouraged. The more honestly you answer questions, the more valuable your opinion. You can make some money, but it's more work than it is worth. Most people end up getting scammed. You could easily do $ per month writing articles. I suggest. Paid Online Surveys from Triaba in the USA. Join Triaba consumer panel and earn money by answering paid surveys on consumption trends in the USA. Fake survey companies might lure you in with a promise that you can quit your job and earn a full-time income completing surveys. This is simply untrue. While. Get Paid by Completing Online Surveys · Earn real cash for each survey you complete · Earn even more by checking in with Zapper's Rewards · Cash out with PayPal. Answering survey questions from 1Q is a great way to share your opinion- and get paid for it! 1Q partners with the world's leading businesses to bring. Swagbucks: Take Paid Surveys, Get Cash and Free Gift Cards*, Find Money Making Deals Swagbucks is a free reward app where you get paid for your opinion. Get paid for completing surveys on your device! It's that simple! · Download our paid surveys app on your device · Complete surveys for money on various topics. Have you ever thought about making some extra money by filling out surveys online? It sounds too good to be true, right? Well, it's actually. To make money with free online surveys, start by checking survey site aggregators, like GetPaidSurveys or BigSpot, for sites that are highly ranked by their. You can get paid for their online surveys through cash or gift cards. Currently, people living in the U.S., United Kingdom, Canada, Spain, Germany, Italy. For most of the legitimate online paid survey sites, you usually don't get paid instantly. You normally redeem your rewards once you've accumulated enough. By participating in surveys through Survey Junkie, users can earn rewards such as cash or gift cards, making it an appealing option for those looking to make a. Sign up for free, and we'll start you off with $1 for your first survey. Turn your opinions into earnings immediately and receive your rewards via PayPal. If the website's minimum payout threshold is low, you'll be able to get your money shortly after completing the survey. On the other hand, platforms with. Completing surveys is where you will earn the most points, but you can also earn points by referring friends to the program or if you get disqualified from a.

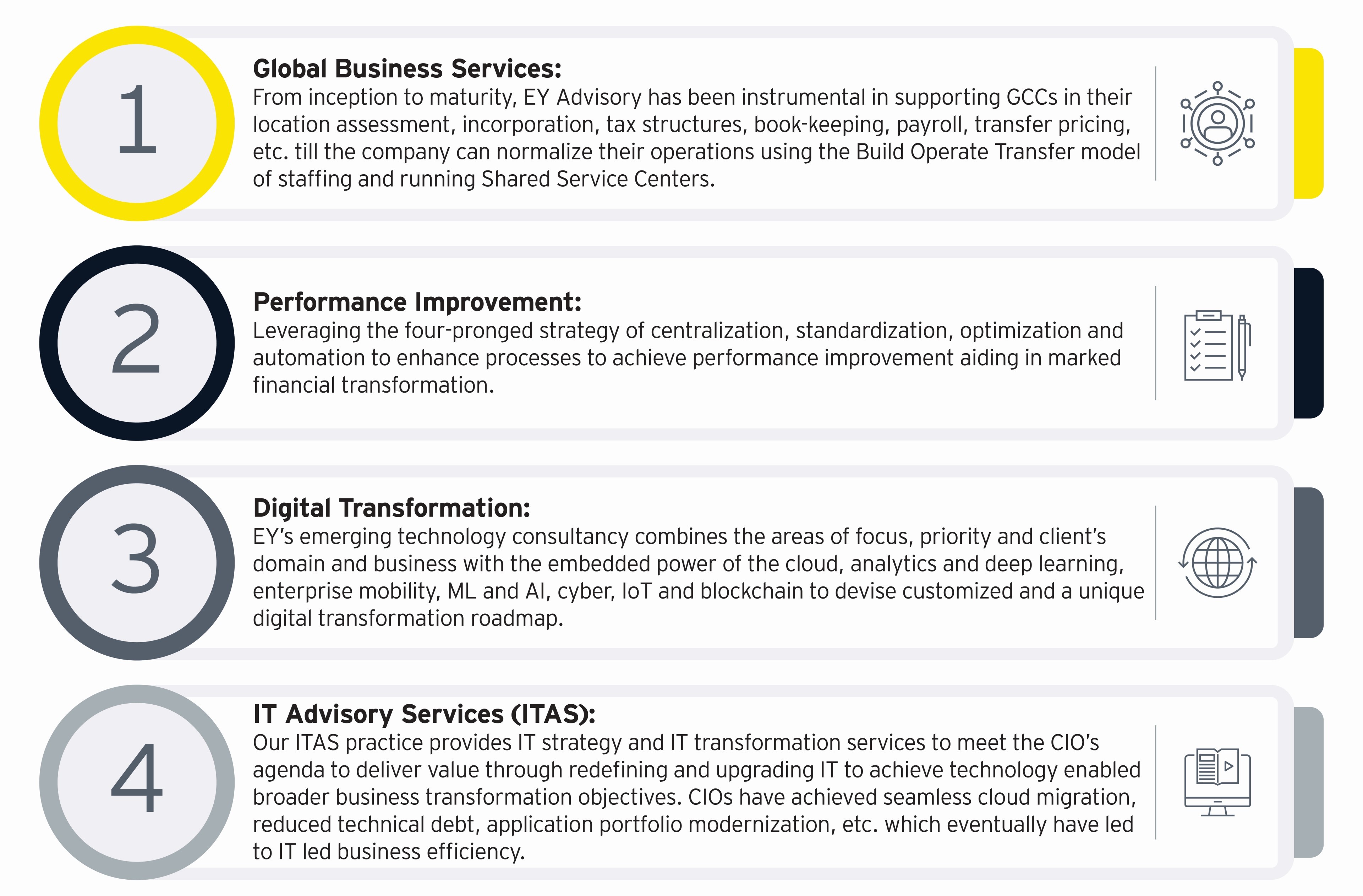

Ey M&A Deals

Big Four firm EY has acquired PeakEPM, as it looks to strengthen its consulting offering for financial services, industrial and energy firms. EY Parthenon - Deal Finance (M&A) - Director - Multiple Locations Jobs in United States · EY Parthenon - Deal Finance (M&A) - Director - Multiple Locations · EY. In brief · The latest Deal Barometer forecasts that US corporate M&A deal volume will increase 20% and US private equity M&A deal volume will be up 16%. An EY report has highlighted a significant increase in publicly disclosed M&A deals in the UK insurance industry, rising from 54 deals in H1. In brief · The latest Deal Barometer forecasts that US corporate M&A deal volume will increase 20% and US private equity M&A deal volume will be up 16%. EY-Parthenon | News | M&A in consulting · EY acquires sustainability consulting firm Afara · EY-Parthenon buys technical and data analytics consultancy QS-2 · EY-. Our M&A consulting and divestiture strategy teams help advise on whether to buy, sell or restructure to boost growth. The Middle East and North Africa (MENA) region saw a total of mergers and acquisitions (M&A) worth $ billion in the first half of , Ernst. EY led consortium advising Pakistan's flag carrier on privatization. M&A deal value in MENA edges up to $44 billion in H1 Big Four firm EY has acquired PeakEPM, as it looks to strengthen its consulting offering for financial services, industrial and energy firms. EY Parthenon - Deal Finance (M&A) - Director - Multiple Locations Jobs in United States · EY Parthenon - Deal Finance (M&A) - Director - Multiple Locations · EY. In brief · The latest Deal Barometer forecasts that US corporate M&A deal volume will increase 20% and US private equity M&A deal volume will be up 16%. An EY report has highlighted a significant increase in publicly disclosed M&A deals in the UK insurance industry, rising from 54 deals in H1. In brief · The latest Deal Barometer forecasts that US corporate M&A deal volume will increase 20% and US private equity M&A deal volume will be up 16%. EY-Parthenon | News | M&A in consulting · EY acquires sustainability consulting firm Afara · EY-Parthenon buys technical and data analytics consultancy QS-2 · EY-. Our M&A consulting and divestiture strategy teams help advise on whether to buy, sell or restructure to boost growth. The Middle East and North Africa (MENA) region saw a total of mergers and acquisitions (M&A) worth $ billion in the first half of , Ernst. EY led consortium advising Pakistan's flag carrier on privatization. M&A deal value in MENA edges up to $44 billion in H1

Capital and transaction strategy through to execution to enable fast-track value creation for inclusive growth. Whether you are a corporate, private equity. EY Report Reveals Surge in UK Insurance M&A Deals in H1 An EY report has highlighted a significant increase in publicly disclosed M&A deals in the UK. Our M&A services: Deal advisory teams help companies better define and refine their growth strategies across transactions and capital management events. Based on economic and market indicators, the latest EY-Parthenon Deal Barometer predicts a rise in deals in the M&A outlook. Learn more in the report. Discover EY Buy and Integrate M&A Advisory services. We help enable strategic growth through integrated mergers and acquisitions, joint ventures and alliances. Our M&A consulting and divestiture strategy teams help advise on whether to buy, sell or restructure to boost growth. On October 6, , EY acquired business services company CMA Strategy Consulting. Acquisition Highlights · M&A Deal Summary · Target. EY has acquired 24 companies, including 4 in the last 5 years. A total of 5 acquisitions came from private equity firms. It has also divested 5 assets. EY provides consulting, assurance, tax and transaction services that help solve our client's toughest challenges and build a better working world for all. In addition to this, EY's M&A consulting practice is ranked amongst the top firms in the world so I know I will be working with the best of the best with the. EY has completed a total of 90 acquisitions. Its most active year was , with 16 acquisitions, and it has averaged 9 acquisitions annually over the past. What EY M&A advisory services can do for you · M&A diligence and valuation · M&A integration · Growth strategy · M&A deal sourcing and origination · M&A tools. Discover M&A advisory services from EY when you buy and integrate. We help enable strategic growth through integrated mergers and acquisitions, joint ventures. Source: MergerMarket, Cap IQ, PitchBook, EY research and analysis. Note: 1. Large Cap includes TCS, Infosys, Wipro, HCL, LTIMindtree, Tech Mahindra. Transactions Partner having advised clients on the majority of M&A deals in the Baltics. Ernst & Young Global Limited, each of which is a separate. Mergers and acquisitions — EY teams can help you assess the strategic fit of a business by evaluating potential synergies, assisting in negotiations and. According to our latest M&A Insights report, the MENA region saw unprecedented M&A activity in with deals, recording 13% growth in. The Deal Speaks with EY's Brian Salsberg in a video interview Private Cos. Environmental Consultancy EI Group Grows Where Clients Go. By Huzair Latif. |. Discover M&A advisory services from EY when you buy and integrate. We help enable strategic growth through integrated mergers and acquisitions, joint ventures. M&A at EY Archived post. New comments cannot be posted and votes cannot be cast. Long story, but I did M&A advisory at EY for a year several.

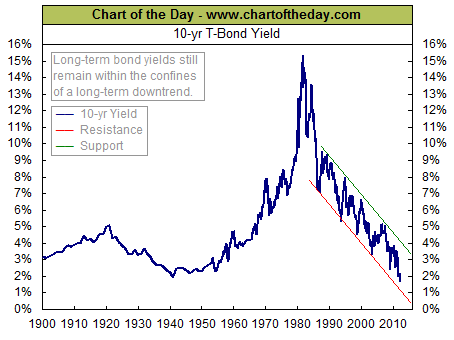

Bond Funds Performance Today

The Lord Abbett Ultra Short Bond Fund seeks to deliver current income consistent with the preservation of capital. View portfolio, performance and more. Vanguard Total Bond Market Index Fund;Investor advanced mutual fund charts by MarketWatch Historical and current end-of-day data provided by FACTSET. All. Out of funds. Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Category. Annual Returns on Investments in, Value of $ invested at start of in, Annual Risk Premium, Annual Real Returns. Year, S&P (includes dividends), 3. Spirit of America Income Fd. SOAIX | Mutual Fund · T. Rowe Price Instl Lng Dur Crdt Fund · PIMCO Long-Term Credit Bond Fund · Vanguard Long Term Investment Grade. Current performance may be lower or higher. Investment value will fluctuate Schwab U.S. Aggregate Bond Index Fund, The investment seeks as closely. Whether you are looking to complement a stock portfolio or to diversify internationally, we have a broad range of bond funds to fit your investing style. Credit exposure is the credit ratings for the underlying securities of the Fund as provided by Standard and Poor's (S&P), Moody's Investors Service, or Fitch. Treasury yields tick higher as traders wait for more clarity on Fed's next move. Treasury yields were little-changed early Monday after falling last week as. The Lord Abbett Ultra Short Bond Fund seeks to deliver current income consistent with the preservation of capital. View portfolio, performance and more. Vanguard Total Bond Market Index Fund;Investor advanced mutual fund charts by MarketWatch Historical and current end-of-day data provided by FACTSET. All. Out of funds. Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Category. Annual Returns on Investments in, Value of $ invested at start of in, Annual Risk Premium, Annual Real Returns. Year, S&P (includes dividends), 3. Spirit of America Income Fd. SOAIX | Mutual Fund · T. Rowe Price Instl Lng Dur Crdt Fund · PIMCO Long-Term Credit Bond Fund · Vanguard Long Term Investment Grade. Current performance may be lower or higher. Investment value will fluctuate Schwab U.S. Aggregate Bond Index Fund, The investment seeks as closely. Whether you are looking to complement a stock portfolio or to diversify internationally, we have a broad range of bond funds to fit your investing style. Credit exposure is the credit ratings for the underlying securities of the Fund as provided by Standard and Poor's (S&P), Moody's Investors Service, or Fitch. Treasury yields tick higher as traders wait for more clarity on Fed's next move. Treasury yields were little-changed early Monday after falling last week as.

Total Return Bond Fund (I) ; United States Treasury Note/Bond, ; United States Treasury Note/Bond, ; Eaton Vance Floating-Rate Fund, ; United States. Another behemoth of the bond investing world is the iconic PIMCO Total Return Fund (PTTAX, $). This actively managed bond fund has been in operation since. Baird Funds & Performance ; TX, BSBIX Short-Term Bond, ; TX, BIMIX Intermediate Bond, ; TX, BAGIX Aggregate Bond, Calamos Total Return Bond Mutual Fund Overview. Through its multi-sector fixed income strategy, the fund invests predominantly in US issuers with the goal of. Market value-weighted, the index seeks to measure the performance of U.S. corporate debt issued by constituents in the iconic S&P Documents. Investors should note that if interest rates rise significantly from current levels, bond fund total returns will decline and may even turn negative in the. PGIM Total Return Bond Fund may appeal to investors seeking a core bond fund that diversifies across sectors and offers a competitive yield and total. Analyze the Fund Fidelity ® Total Bond Fund having Symbol FTBFX for type mutual-funds and perform research on other mutual funds. Learn more about mutual. Vanguard Total Bond Market Index Fund;Investor advanced mutual fund charts by MarketWatch Historical and current end-of-day data provided by FACTSET. All. For the first time since , over half of fixed income markets are yielding over 4%.* Advisors may want to consider bringing their bond allocation back to. Vanguard Total Bond Market Index Fund (BND) ; YTD Return · % · % ; 1-Year Return · % · % ; 3-Year Return · % · %. Performance quoted is past performance and is no guarantee of future results. Current performance may be lower or higher. Investment value will fluctuate. Current and future results may be lower or higher than those shown. Investing for short periods makes losses more likely. Prices and returns will vary, so. Current performance may be higher or lower than returns shown. Call for most recent month-end performance. Investments in bonds and other. Spirit of America Income Fd. SOAIX | Mutual Fund · T. Rowe Price Instl Lng Dur Crdt Fund · PIMCO Long-Term Credit Bond Fund · Vanguard Long Term Investment Grade. High Yield Bond Funds ; % · % · % · %. Baird Funds & Performance ; TX, BSBIX Short-Term Bond, ; TX, BIMIX Intermediate Bond, ; TX, BAGIX Aggregate Bond, Amundi Climate Transition Core Bond Fund - A · CTBAX · $ · $ · $ ; Pioneer AMT - Free Municipal Fund - A · PBMFX · $ · $ · $ ; Pioneer. Although most bond funds diversify credit risk well enough, the weighted average credit rating of a bond fund will influence its volatility. While lower-credit-. Current performance may be higher or lower than the performance shown. Total returns for a period of less than one year are cumulative. Returns without sales.

How To Ask Financial Aid For More Money

The financial aid office can review your current offer and give you an idea of what additional funding might be available. Some questions to ask when talking. Importantly, grant money does not have to be repaid. Fill out the FAFSA, which often determines your eligibility for grants, as soon as possible. Learn more. If you need more financial aid, contact your school's financial aid office. Here are other options you can consider if you didn't receive enough financial aid. How to request a review · Login to your secure Student Aid account. · Choose 'Request for Review' on the right-hand menu. · Select your reason for submitting a. financial planning and money management. Topics include applying for aid, scholarships, budgeting, credit scores, repaying loans and more. One-on-One. When appealing an award letter to ask for more financial aid, a college may ask you to write a letter expressing the reasons behind your appeal. Amazingly, in many cases, all you have to do is ask. How to ask for more financial aid: appeals vs. negotiations At Bright Horizons College Coach, our college. Requesting more FAFSA money can be broken down into two simple steps: contact your financial aid office and write a short summary of the special circumstances. If your student has received college acceptances and offers of merit scholarship money, now is a good time to compare those awards and craft a plan to go back. The financial aid office can review your current offer and give you an idea of what additional funding might be available. Some questions to ask when talking. Importantly, grant money does not have to be repaid. Fill out the FAFSA, which often determines your eligibility for grants, as soon as possible. Learn more. If you need more financial aid, contact your school's financial aid office. Here are other options you can consider if you didn't receive enough financial aid. How to request a review · Login to your secure Student Aid account. · Choose 'Request for Review' on the right-hand menu. · Select your reason for submitting a. financial planning and money management. Topics include applying for aid, scholarships, budgeting, credit scores, repaying loans and more. One-on-One. When appealing an award letter to ask for more financial aid, a college may ask you to write a letter expressing the reasons behind your appeal. Amazingly, in many cases, all you have to do is ask. How to ask for more financial aid: appeals vs. negotiations At Bright Horizons College Coach, our college. Requesting more FAFSA money can be broken down into two simple steps: contact your financial aid office and write a short summary of the special circumstances. If your student has received college acceptances and offers of merit scholarship money, now is a good time to compare those awards and craft a plan to go back.

How to get more financial aid if there's a gap in your funding · 1. Contact the financial aid office · 2. Apply for scholarships and grants · 3. Appeal your award. We will reassess your eligibility for financial aid based on your new financial situation. Additional expenses. We may be able to increase your “budget” for. It's time to start making a plan for your education · 1. Explore additional scholarships · 2. Submit your FAFSA · 3. FAFSA Submission Summary (FSS) · 4. Determining. This allows us to use your federal financial aid to cover room and meal plan fees and non-instructional fees such as orientation, parking permits and more. This. If families aren't sure how to approach appealing their financial aid offer, they should call the financial aid or admissions office. It doesn't hurt to ask for. Submit the Student Employment Petition plus documentation to the Student Employment Section of Student Financial Aid and Scholarships at S Criser Hall. Best Practices for Working with a Financial Aid Office · Set up an appointment to meet with an advisor as soon as possible. · Come prepared with a list of. A financial aid appeal, also referred to as a professional judgment, is the process by which a student and their family works with the school to receive a more. You may request a re-evaluation of your aid or an appeal of a financial aid policy or decision. Our ability to provide additional assistance depends on the. We will reassess your eligibility for financial aid based on your new financial situation. Additional expenses. We may be able to increase your “budget” for. The financial aid office can review your current offer and give you an idea of what additional funding might be available. Some questions to ask when talking. If your student has received college acceptances and offers of merit scholarship money, now is a good time to compare those awards and craft a plan to go back. To determine how much loan money to accept, make a list of your college and living expenses and the resources you'll have available to pay them; in other words. A financial aid appeal offers you an opportunity to ask your school for more financial assistance. But just walking into your advisor's office and asking for. Once you have gathered supporting paperwork, begin writing your appeal letter, clearly explaining your reasons for seeking additional aid. Don't Call it Quits. Appeals may not be done by phone. You should never appeal your financial aid award just to seek more money. There should be a specific set of reasons for your. Colleges take different approaches to grants, with some giving more grants up front (called front-loading of grants) and some weaving grants evenly among the. All students applying for financial aid should first complete the FAFSA, the Free Application for Federal Student Aid. Aid From Your College or Career/Trade School · Visit your school's financial aid page on its website, or contact the financial aid office. · Ask at the department. How to Ask for More Merit Scholarship Money · check-circle icon. Review the School's Appeal Process. You can learn more about the financial aid appeal process by.

Does Taking Out A Debt Consolidation Loan Hurt Your Credit

Debt consolidation loans just show up as a loan, not the purpose for the loan. Bank/credit union loans will be slightly better for your score. Debt consolidation can positively impact your credit score by lowering your overall credit utilization ratio. By paying off multiple credit card balances with a. At the start, most debt consolidation methods have a negative effect on your credit score. They lower your score temporarily for several reasons. For example. Although you may initially see a dip in your credit score, with time and consistency, paying off your debt with one consolidated loan should improve your credit. Your credit score may drop slightly directly after you consolidate debt. Over time, however, a responsible financial approach toward debt consolidation can. For many, the goal is to get a lower interest rate on a debt consolidation loan than they're currently paying across their multiple loans. This may be possible. Debt consolidation also has some downsides to consider. For one, when you take out a new loan, your credit score could suffer a minor hit, which could affect. Consolidation often significantly lowers the percentage of total credit you're using (called credit utilization) by paying off cards and loans. This factor. Any lender will make a “hard inquiry” on your credit when you apply formally for a loan, and this typically results in a drop of about 10 points in your credit. Debt consolidation loans just show up as a loan, not the purpose for the loan. Bank/credit union loans will be slightly better for your score. Debt consolidation can positively impact your credit score by lowering your overall credit utilization ratio. By paying off multiple credit card balances with a. At the start, most debt consolidation methods have a negative effect on your credit score. They lower your score temporarily for several reasons. For example. Although you may initially see a dip in your credit score, with time and consistency, paying off your debt with one consolidated loan should improve your credit. Your credit score may drop slightly directly after you consolidate debt. Over time, however, a responsible financial approach toward debt consolidation can. For many, the goal is to get a lower interest rate on a debt consolidation loan than they're currently paying across their multiple loans. This may be possible. Debt consolidation also has some downsides to consider. For one, when you take out a new loan, your credit score could suffer a minor hit, which could affect. Consolidation often significantly lowers the percentage of total credit you're using (called credit utilization) by paying off cards and loans. This factor. Any lender will make a “hard inquiry” on your credit when you apply formally for a loan, and this typically results in a drop of about 10 points in your credit.

If you do it right, debt consolidation might slightly decrease your score temporarily. The drop will come from a hard inquiry that appears on. Taking out a debt consolidation loan won't affect your credit score any more than other types of finance. It's all about how you handle the repayments since. If you make your payments regularly, a debt consolidation loan will not hurt your credit score. In fact, over the long term, there are two ways it may help your. 1. When you check your rate, we check your credit report. This initial (soft) inquiry will not affect your credit score. If you accept your. While there's a definite upside to the ease of a single payment and the temptation of a lower interest rate, consolidation can hurt your credit score in a few. You qualify for a lower interest rate If you're struggling to get out of debt but still have good enough credit to qualify for a debt consolidation loan with. Borrowers may also benefit from lower interest rates when taking out a debt consolidation loan. This is particularly true for credit card debt. For example. Many Canadians worry about whether consolidating their loans will have an impact on their finances, but the truth is that debt consolidation does not hurt. You use this loan to pay off your credit card debt, then repay the loan in monthly installments, usually with a lower interest rate than you were paying on. Improved credit score. When you get a debt consolidation loan, the lender pays off your old debts, so you only have one new loan to pay. This is good for. Each of these has an impact on your credit report and score. Though the biggest impact will be determined by how well you manage the new loan. Compare Rates. If you do it right, debt consolidation might slightly decrease your score temporarily. The drop will come from a hard inquiry that appears on. Debt Consolidation Loan: DIY Pitfalls · Your credit score could get a boost. · Zeroing out your credit cards with a consolidation loan will help the “credit. While there's a definite upside to the ease of a single payment and the temptation of a lower interest rate, consolidation can hurt your credit score in a few. As long as you follow the terms of your consolidation loan and make your payments on time, your credit rating should not be negatively affected. The biggest. But you can get out of debt faster with total payments that are up to 50 percent less. It's also important to note that your credit counselors will help you set. When there are several payments to address each month, it's easier to miss one, which could hurt your credit score. You could consider consolidating debt with a. Credit card debt consolidation is a good way to get a handle on monthly payments and decrease debt, but it must be done right if you want to do it without. taking out another loan, then repay the line of credit as you use it. 3. Refine your debt paying strategy. Once you've consolidated your debts into as few loans. Does debt consolidation hurt your credit? Ultimately, it depends on various factors, including how you manage your loan and your overall financial.

How To Start Your Own Vending Machine Business

Start Your Own Vending Machine Business: Collect Monthly Full-Time Income on Autopilot by Building a Vending Machine Empire | The Complete Beginners' Guide. The vending machine business allows you to start small with money you already have, avoid taking out loans, and finance this side job with your current one. Anyone can start a vending machine business. You do need some startup capital but one of the advantages of this type of business is that startup costs can be as. Get the inside scoop on how to start up in this lucrative, flexible business. Expert advice covers: How to select the hottest new products for vending machines. Don't begin by ask them anything. Start off by telling them what you can offer them and why a machine would be beneficial for them in their. Steps to Starting Your Vending Machine Business · Create a Business Plan · Legally Form Your Business · Find Locations for Your Vending Machines · Purchase Vending. 1. Research and Planning: Conduct market research to identify the demand and potential profitability of vending machine businesses in your target location. Have a plan – · Purchase your first vending machine · Choose the perfect locations to start your business · Negotiate specific sales “Commissions” on the business. First decide if a vending machine business is right for you. · Remember that a vending machine business requires a minimum of 2 hours a week of your time. Start Your Own Vending Machine Business: Collect Monthly Full-Time Income on Autopilot by Building a Vending Machine Empire | The Complete Beginners' Guide. The vending machine business allows you to start small with money you already have, avoid taking out loans, and finance this side job with your current one. Anyone can start a vending machine business. You do need some startup capital but one of the advantages of this type of business is that startup costs can be as. Get the inside scoop on how to start up in this lucrative, flexible business. Expert advice covers: How to select the hottest new products for vending machines. Don't begin by ask them anything. Start off by telling them what you can offer them and why a machine would be beneficial for them in their. Steps to Starting Your Vending Machine Business · Create a Business Plan · Legally Form Your Business · Find Locations for Your Vending Machines · Purchase Vending. 1. Research and Planning: Conduct market research to identify the demand and potential profitability of vending machine businesses in your target location. Have a plan – · Purchase your first vending machine · Choose the perfect locations to start your business · Negotiate specific sales “Commissions” on the business. First decide if a vending machine business is right for you. · Remember that a vending machine business requires a minimum of 2 hours a week of your time.

How to Start a Vending Machine Business · How much does it cost to start a vending machine company? · Researching your area · Selecting your equipment for specific. Before starting a vending machine business, you have to go through the process of acquiring all legal permits. Make sure to obtain all licenses, certifications. Steps to start a vending machine business · 1. Choose a business structure · 2. Determine what you will sell · 3. Select the right location · 4. Get any permits. Planning and research: Investigate the vending machine market first. Recognize the market's demand, rivalry, and profit possibilities. Find the. 1. Identify What You Want To Sell · 2. Research Ideal Locations and Products · 3. Put a Business Plan Together · 4. Determine Your Business Structure · 5. Get a. Anyone can start a vending machine business. You do need some startup capital but one of the advantages of this type of business is that startup costs can be as. In reality, starting a vending business can be as inexpensive as buying a few coin-operated, bulk machines and stocking them with certain low-cost products. Planning and research: Investigate the vending machine market first. Recognize the market's demand, rivalry, and profit possibilities. Find the. The 8 Steps to Start a Vending Machine Business · 1. Formalize Your Business · 2. Open a Business Bank Account · 3. Choose the Type of Vending Machine(s) You Want. Steps to Starting a Vending Machine Business · Decide if Vending is Right For You · Do Your Homework · Target Your Vending Customers and Decide What you Want to. To launch your vending machine business successfully, it's essential to register your business officially. Choose a legal structure, such as a sole. You need to do your homework in your specific area. Look for high traffic foot areas. Laundromats, gyms, etc. Don't begin by ask them anything. You should also conduct a thorough background check on the area—to ensure that there aren't any local regulations or laws against custom vending machines. How to Start a Vending Machine Business · Create a business plan · Choose a business structure · Name your business · Register your business and open financial. By purchasing an existing vending machine business you can start with a steady base that will allow you to get cheaper bulk pricing on the products you place in. Step 1: Consider Your Options · Step 2: Research the Competition · Step 3: Find Suppliers · Step 4: Establish Locations · Step 5: Maintain Vending Machines · Step 6. Steps to Starting Your Vending Machine Business · Create a Business Plan · Legally Form Your Business · Find Locations for Your Vending Machines · Purchase Vending. In developing your vending machine business plan, you might have determined that you need to raise funding to launch your business. If so, the main sources of. First decide if a vending machine business is right for you. · Remember that a vending machine business requires a minimum of 2 hours a week of your time. Approach property managers, businesses, or institutions to place your machines. Ensure the location matches the product—for instance, a health product machine.

1 2 3 4 5