30h4.site Market

Market

How To Move Clothes When Moving

Cardboard boxes are the usual standard for items when moving. Using sturdy, high-quality cardboard boxes are a great option when you have clothes that are. One side of the wardrobe box is designed to pull out and fold down – to make it easier to add your hanging clothes. Pull this wall down next. After this insert. Use clear heavy duty plastic bags. You can fit a bunch in them, clothes pillows soft stuff etc. its easier for packing cause u can throw on top. The most recommended way to pack hanging clothes is to use wardrobe boxes. These specialized wardrobe boxes are the safest option when it comes to preventing. The best way to move clothes on hangers is a wardrobe box. Designed with a built-in hanging rod, a wardrobe box lets you easily move your hanging clothes. Utilize Wardrobe Boxes: Wardrobe boxes equipped with hanging rods are perfect for transporting hanging clothes. Simply transfer your garments from the closet to. Moving can be difficult, especially if you have to pack up your clothes and transport them to your new home. Declutter old dresses and organize. We've got your quick guide to packing your clothes for moving in hand below, with all our hints and tips to steer you away from some common mistakes. The best way to fold clothes for a move is one that saves space and minimizes the number of boxes or suitcases you'll need. Cardboard boxes are the usual standard for items when moving. Using sturdy, high-quality cardboard boxes are a great option when you have clothes that are. One side of the wardrobe box is designed to pull out and fold down – to make it easier to add your hanging clothes. Pull this wall down next. After this insert. Use clear heavy duty plastic bags. You can fit a bunch in them, clothes pillows soft stuff etc. its easier for packing cause u can throw on top. The most recommended way to pack hanging clothes is to use wardrobe boxes. These specialized wardrobe boxes are the safest option when it comes to preventing. The best way to move clothes on hangers is a wardrobe box. Designed with a built-in hanging rod, a wardrobe box lets you easily move your hanging clothes. Utilize Wardrobe Boxes: Wardrobe boxes equipped with hanging rods are perfect for transporting hanging clothes. Simply transfer your garments from the closet to. Moving can be difficult, especially if you have to pack up your clothes and transport them to your new home. Declutter old dresses and organize. We've got your quick guide to packing your clothes for moving in hand below, with all our hints and tips to steer you away from some common mistakes. The best way to fold clothes for a move is one that saves space and minimizes the number of boxes or suitcases you'll need.

Here are some helpful tips to make the process of packing your clothes for moving day easier and stress-free. One of the best ways to pack your clothes is to use vacuum-sealed bags. These bags are designed to remove all the air from your clothes, which will prevent. 5. Tips on How to Pack Clothes Most Effectively for a Move · Heavy clothes should always be placed at the bottom of the boxes, with lighter ones on top. · Clean. Best Way To Pack Clothes For Moving · Use clean, dry plastic bins with lids for folded clothing items · Wash clothes before packing · Roll your sweaters and t-. Knowing how to pack clothes saves time and effort. They arrive at your new home clean, fresh, and organized ‒ easy to unpack and put away. Use clear heavy duty plastic bags. You can fit a bunch in them, clothes pillows soft stuff etc. its easier for packing cause u can throw on top. Often used to transport suits or formal wear, garment bags offer additional protection to some of the more expensive clothing items that you might choose to. How do you pack clothes without creasing them? The best way to pack clothes without creasing them is to hang them and transport them that way. You can use. The following tips on the best way to pack clothes for moving can help you to streamline and organize the moving process for your clothing. In this guide, we'll explore how to efficiently pack your clothes when moving, so your garments arrive at your new place just as immaculate as they were before. The best way to pack clothes for moving is to group them. A Common, but very useful tip on how to pack clothes for moving is to have them strategically. Place hanging clothes in wardrobe boxes and put foldable garments in boxes. Remember to pack a suitcase to keep with you containing enough clothes to last. You will need supplies such as moving boxes, labels, wardrobe boxes, suitcases, duffle bags, vacuum bags or garbage bags, bubble wrap, and packing tape. The obvious choice is to buy a few cardboard boxes to pack your clothes in, but there are some other great alternatives to packing your clothes for moving. Always remember plan ahead. Then work your plan. Here are eleven tips for getting your clothing ready for a cross country move. We'll explore tried and tested strategies for how to pack clothes for moving, protecting them during transit, and minimizing the hassle of unpacking and. The first step to sort this all out is to get all of your clothes out from your dresser, closet, attic, and below your bed. Simply open up the garbage bag (a large 56L at least in size) to “swallow up” the clothes from below. Pull the bag up and around the clothes. Once they've been. Keep your winter clothes on their hangers, place them into hanging vacuum seal storage bags, and flatten them out by vacuuming our any excess air. Fit more. We've got your quick guide to packing your clothes for moving in hand below, with all our hints and tips to steer you away from some common mistakes.

Best Unsecured Car Loans

Auto Loans · Best Auto Loan Rates · Best Auto Loan Refinance Lenders · Best Auto Loan Refinancing Rates · Wells Fargo Auto Loan Review · TD Bank Auto Loan Review. Top automobile loan FAQs. How do I get the title lien released from For unsecured loans and secured auto loans, the term of your loan is one of. An unsecured car loan is when no such collateral exists, and the lender has to grant an auto loan based on the value or credit history of the car buyer. The average rate for a secured auto loan is around 7%, and this jumps to between 10% and 11% for unsecured loans. Of course, these are just averages, and the. While mainstream consumer lenders may offer unsecured loans that you can use to buy a car (or anything else), these loans tend to have a higher interest rate. Auto loans are available now on new and used cars through AAA. Auto loan rates as low as %. Talk with us & find out more about our car finance options. What does it really mean, and what are the benefits of choosing an unsecured loan? When it comes to choosing the best car loan, there's no one-size-fits-all. Contact us to discuss the option that best meets your needs. *Check Auto Loan Rates: APRs that will display include a % discount for. Unsecured car loans are mostly given for home repairs or upgrades – situations where there isn't an item a lender can use as collateral. There are many places. Auto Loans · Best Auto Loan Rates · Best Auto Loan Refinance Lenders · Best Auto Loan Refinancing Rates · Wells Fargo Auto Loan Review · TD Bank Auto Loan Review. Top automobile loan FAQs. How do I get the title lien released from For unsecured loans and secured auto loans, the term of your loan is one of. An unsecured car loan is when no such collateral exists, and the lender has to grant an auto loan based on the value or credit history of the car buyer. The average rate for a secured auto loan is around 7%, and this jumps to between 10% and 11% for unsecured loans. Of course, these are just averages, and the. While mainstream consumer lenders may offer unsecured loans that you can use to buy a car (or anything else), these loans tend to have a higher interest rate. Auto loans are available now on new and used cars through AAA. Auto loan rates as low as %. Talk with us & find out more about our car finance options. What does it really mean, and what are the benefits of choosing an unsecured loan? When it comes to choosing the best car loan, there's no one-size-fits-all. Contact us to discuss the option that best meets your needs. *Check Auto Loan Rates: APRs that will display include a % discount for. Unsecured car loans are mostly given for home repairs or upgrades – situations where there isn't an item a lender can use as collateral. There are many places.

Rev up your finance game and take charge of those high car payments. America's Best Banks, - Newsweek America's Best Regional Banks, Instead of buying a new or used car, perhaps you need a major car repair. In that case, consider a Tech CU Personal Loan. We offer unsecured personal loans to. Unsecured auto loans could be attractive options for borrowers looking for inexpensive cars. They are great alternatives for borrowers who don't qualify for. Contact us to discuss the option that best meets your needs. *Check Auto Loan Rates: APRs that will display include a % discount for. Compare the best bad credit auto loan rates in September ; Capital One, Not specified, 24 to 84 months ; Autopay, Starting at %, 12 to 84 months ; Carvana. You can use the money to consolidate debt, pay for school or fulfill a short-term need for cash. APPLY FOR AN UNSECURED PERSONAL LOAN This site is best viewed. Secured vs. Unsecured Car Loan Rates · Secured Car Loans: Average interest rates for secured loans can range from % to % per annum. Application fees. Drive the car you want with a LightStream new or used auto loan. Loan amounts up to $ and low rates for those with good credit. Car Loan Rates · First National Bank • Used Car Loan • 72 Months · LightStream • Used Car Loan • 72 Months · Popular Bank • Used Car Loan • 72 Months · WSFS Bank •. Secured loans tend to have lower rates than unsecured loans and you might be able to borrow a greater amount or extend the loan term further than with an. An “unsecured auto loan” is just an unsecured loan that a bank is advertising to people who are in the market for a car. Learn about unsecured auto loans, and how they differ from secured loans, with South Point Hyundai so you can make the best financial decision for your. Whether new or used, HRCU members can choose the auto loan option that best suits their car buying or refinancing needs Unsecured Personal Loans. Student Loans Auto Loan Unsecured Line Of Credit. We're here to help. Visit a You've got your eye on a new vehicle, but what's the best way to pay for it? Our low-rate auto loans are great for both new and used vehicles. We also offer auto loan refinancing options. Be on your way in no time with a quick and easy. Vehicle loans. Vehicle loan features: Fixed rate loans and fixed payment Credit cards. Back to the top. ; Routing Number About. Personal loans vs. auto loans ; LightStream Personal Loans · % - %* APR with AutoPay · Debt consolidation, home improvement, auto financing, medical. Explore the Benefits of Unsecured Personal Car Loans · Let's get started on a flexible unsecured solution for you. Flexible terms are available. ; Get the Best No. We'll get you moving · Same low rates for new and used vehicles · Finance up to % of the vehicle purchase price · You might not need a down payment · Flexible. An unsecured car loan is best described as a personal loan for a car. Unlike secured car loans, personal car loans are not tied to the asset.

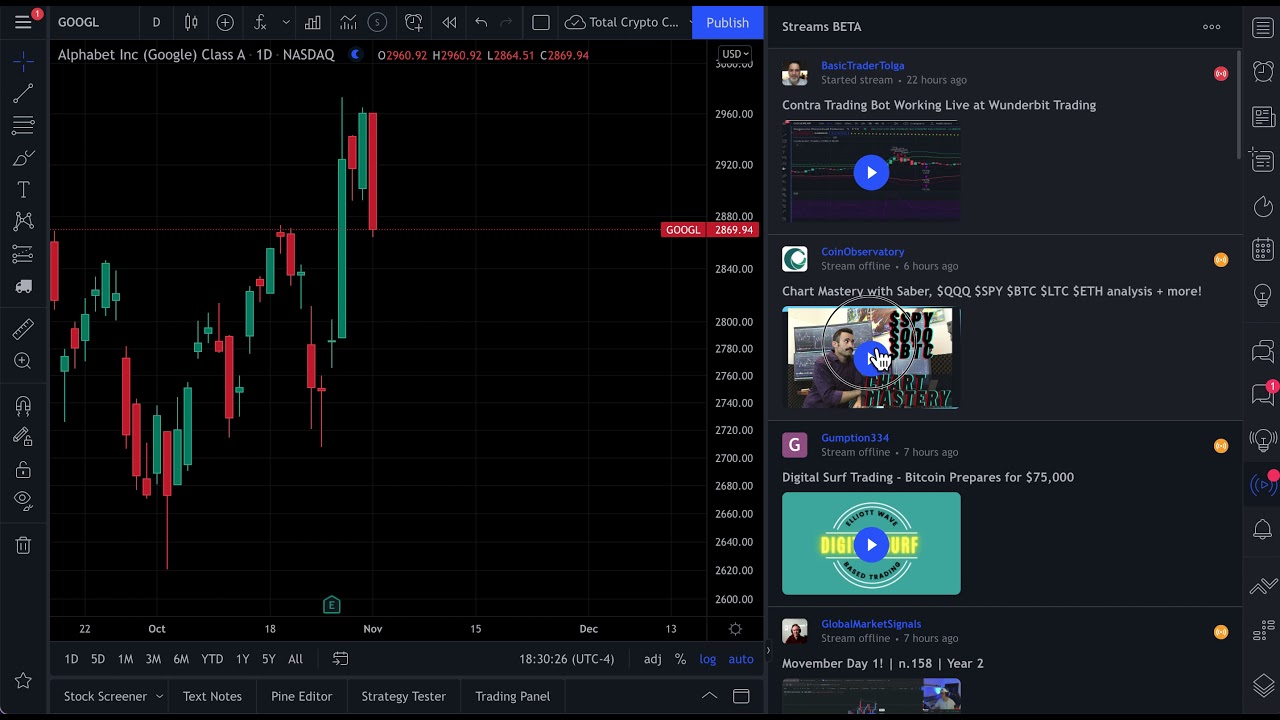

Livestream Trading

The only trading group in the world that offers a full working trading system for FREE to all of our community members so you can skip the headaches. Livestream Trading. Day Trade Options With Us LIVE for Voice Alerts and Screen Share. 🗣️. Trading Floor. Immerse Yourself Into Our Family of Profitable Traders. Join us on YouTube Live every weekday from am to pm EST to trade the NYSE, NASDAQ, CME, BOVESPA and the TORONTO STOCK EXCHANGE, TMX. We are excited to announce a new addition to the Trader's Thinktank®: the Livestream Trading feature. This new offering is designed to elevate your trading. Live Day Trading with a Professional Team. Learn how to Trade Futures and Stocks with 24/7 Chat Rooms, Live Trade Alerts, and Daily Webinars. Focused on using a systematic process that eliminates guesswork and emotions from trading decisions, LiveStreamTrading teaches proven strategies for day trading. HoneyDripTrading they go live every day before the market opens and call live plays as well as live stream so you can see screen on zoom. Watch our daily livestreams below as we prep, analyze, and trade the futures markets in real-time with platform tips and technical analysis along the way. LiveStream Trading is a leading educational stock trading service designed to allow users to follow and learn from a professional day trader via our chat room. The only trading group in the world that offers a full working trading system for FREE to all of our community members so you can skip the headaches. Livestream Trading. Day Trade Options With Us LIVE for Voice Alerts and Screen Share. 🗣️. Trading Floor. Immerse Yourself Into Our Family of Profitable Traders. Join us on YouTube Live every weekday from am to pm EST to trade the NYSE, NASDAQ, CME, BOVESPA and the TORONTO STOCK EXCHANGE, TMX. We are excited to announce a new addition to the Trader's Thinktank®: the Livestream Trading feature. This new offering is designed to elevate your trading. Live Day Trading with a Professional Team. Learn how to Trade Futures and Stocks with 24/7 Chat Rooms, Live Trade Alerts, and Daily Webinars. Focused on using a systematic process that eliminates guesswork and emotions from trading decisions, LiveStreamTrading teaches proven strategies for day trading. HoneyDripTrading they go live every day before the market opens and call live plays as well as live stream so you can see screen on zoom. Watch our daily livestreams below as we prep, analyze, and trade the futures markets in real-time with platform tips and technical analysis along the way. LiveStream Trading is a leading educational stock trading service designed to allow users to follow and learn from a professional day trader via our chat room.

LiveStream Trading has 5 stars! Check out what 72 people have written so far, and share your own experience. | Read Reviews out of Started teaching trading in , created my own indicators and trading software to trade gold, indices and digital currencies. One-stop financial live stream. LiveStream Trading Affiliate Program - Is It Legit or Scam? Check out real reviews, payment proofs, affiliate program details about LiveStream Trading. Livestream Trading Coupons. Inspirational designs, illustrations, and graphic elements from the world's best designers. Want more inspiration? Browse our. Daytrader / 18 Years Experience Daily LIVE Small Cap and Futures Trading🎙️ Join Us LIVE · Join us for an exclusive 2 week free trial this week only!! Join us on YouTube Live every weekday from am to pm EST to trade the NYSE, NASDAQ, CME, BOVESPA and the TORONTO STOCK EXCHANGE, TMX. GameStop tumbles 40% as 'Roaring Kitty' trader says little new about retailer on livestream Trading in GameStop was halted multiple times during the stream. Stock and Futures Trader with 19 Years Experience ⚙️ Systematic Trading Process 🎙️ Daily LIVE Streamed Trading Trade with a Pro. Trade like a Pro. I wanted to share my new book Day Trading Attention releasing May 21st - 30h4.site I think it will help so many of you grow. These 32 Available LiveStream Trading discount codes last updated TODAY can help you save Upto 60% OFF. Buy cheaper with LiveStream Trading coupons & promo. Welcome to the #1 Trading Community that puts YOU first. Learn how to trade stocks, options, and futures with a professional team. Day trader of stocks and futures with 18 years of experience in the financial markets. Trading educator, coach, and mentor to students at. Trade Plans for Futures and #SPY this week #ES #futures #daytrading Photo by LiveStream Trading in Punta Cana, Republica Dominicana. Livestream Trading Sale. Inspirational designs, illustrations, and graphic elements from the world's best designers. Want more inspiration? Browse our search. out of 5 stars - Shop LiveStream Trading Mug created by LiveStream_Trading. Personalize it with photos & text or purchase as is! 30h4.site is a platform that offers trading education and mentorship. The service is praised for its affordability. Alex Vieira Livestream Trading Selling AMC at $75 after calling a bottom at $ Linking the market drivers from overnight in the US and across Asia into the region's trading day, with deep dive analysis of the top business, energy and. LiveStream Trading | LiveStream Trading is a stock trading group designed to allow users to watch and learn from a professional day trader via live screen. Join our Expert-Led Live Trading Sessions! Learn and trade with the latest financial market news. Watch our trading livestream now!

How To Get My Car Refinanced With Bad Credit

If you have a low credit score, you may want to have a cosigner on your refinance application. Having a cosigner with good credit can help you qualify for. Waiting longer, such as six months to a year, will give your credit score a chance to recover from the credit inquiry and loan that will be on your credit. The good news is that you absolutely can refinance a car loan with bad credit. Even with a low credit score, you may be able to receive better terms that will. Refinance your car loan through Upstart and save on your monthly car payments. Check your rate in minutes — without impacting your credit score. But of course, if you don't make regular payments on your auto loan, it will work against you. Your credit score will dip, lenders will look the other way, and. Yes, you can refinance a car. The process involves shopping around for a new loan with better terms or rates, applying for the new loan, and. Auto Credit Express has long been one of our favorite auto lending networks for bad credit because it partners with a massive group of lenders who each have. The approval process for a refinance can take as little as a few minutes. After your new loan is signed, you can have up to 60 days with no payments before. Can I Refinance my Auto Loan with Poor Credit? Don't assume that a bad credit score or lack of credit history will disqualify you from refinancing your auto. If you have a low credit score, you may want to have a cosigner on your refinance application. Having a cosigner with good credit can help you qualify for. Waiting longer, such as six months to a year, will give your credit score a chance to recover from the credit inquiry and loan that will be on your credit. The good news is that you absolutely can refinance a car loan with bad credit. Even with a low credit score, you may be able to receive better terms that will. Refinance your car loan through Upstart and save on your monthly car payments. Check your rate in minutes — without impacting your credit score. But of course, if you don't make regular payments on your auto loan, it will work against you. Your credit score will dip, lenders will look the other way, and. Yes, you can refinance a car. The process involves shopping around for a new loan with better terms or rates, applying for the new loan, and. Auto Credit Express has long been one of our favorite auto lending networks for bad credit because it partners with a massive group of lenders who each have. The approval process for a refinance can take as little as a few minutes. After your new loan is signed, you can have up to 60 days with no payments before. Can I Refinance my Auto Loan with Poor Credit? Don't assume that a bad credit score or lack of credit history will disqualify you from refinancing your auto.

Refinance my car loan with poor credit Although some companies consider applicants with poor credit history risky to lend to, this doesn't necessarily mean. Refinance a car with bad credit Thanks to our panel of lenders, we can look to help people with a variety of different circumstances to refinance. Just. Some lenders may be willing to work with you on refinancing your loan if you have bad credit. However, if your credit score dropped since you first secured the. Love your car, but hate your rate? Refinancing an auto loan is essentially getting a new loan with new terms. Check out our low rates and see if refinancing can. Even if you had or have bad credit, you may still be able to refinance your auto loan. If you think refinancing your car loan might be right for you, here. We strive to make lowering your monthly car payment as easy and seamless as possible. You can apply to refinance your auto loan online, and most loans can close. How to refinance a car loan in 5 steps · 1. Decide if refinancing makes sense for you · 2. Check your credit · 3. Gather relevant documents · 4. Ask the right. Advertised as low as APR (Annual Percentage Rate) assumes excellent borrower credit history. Your actual APR may differ based on your credit history, approved. What do I need to refinance my vehicle? It generally makes sense to refinance your auto loan when your credit has improved, when interest rates drop, or your financial situation has changed, for. It is possible to refinance your car loan with bad credit. However, improving your credit score prior to applying for refinancing may help you secure better. Refinancing a car loan means replacing your old loan with a new loan that has terms that benefit you in some way. The new loan can either be with a different. my credit/ the car loan I have right now. If anyone has any advice for me would be greatly appreciated thank you! (The loan company has been. The goal of refinancing is to get a new auto loan with a lower interest rate. · Your credit score will impact your rate; higher scores earn lower rates. Check your credit report. If you have bad credit, make sure you understand why. · Add a cosigner. Even if you do everything right, waiting for your credit rating. If you have low credit, you can still refinance your auto loan. Additionally, you may take actions to improve your credit score and qualify for lower interest. Attempting to refinance with a poor credit score is not impossible, but it does make the task more difficult. This is especially the case if your credit score. Most lenders consider your current loan, the value of your vehicle, your credit score and any outstanding debt when determining refinancing. Time to Read. 2. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining on. What Is the Goal of Refinancing an Auto Loan. When you refinance a car loan, you take out a new loan to pay off the balance you still owe on your existing loan.

Ive Got Fat

How do I know if I have visceral fat? How can I reduce visceral fat getting enough sleep. Resources and support. For more information and support. That may be because you are not getting the right nutrients you need from your diet. Fat is stored throughout the body and that it produces chemicals and. Trans fat: Trans fat makes you fatter than other foods with the same According to the latest research, not getting enough sleep impairs your fat. Stream I Got This Fat Girl Fetish by DJ Refreshing Beverage on desktop and mobile. Play over million tracks for free on SoundCloud. Let's talk about how I got so fat. My body and weight has changed a lot in the last 8 years. How did I end up morbidly obese? The number on the scale is going up because your body is working hard, not because you are truly putting on fat. This is another one that feels counterintuitive. got less than 10 hours of sleep were 76% more likely to have overweight or obesity, while each additional hour of sleep reduced the likelihood by 21%. 3. All these “miracle” diets are supposed to help you melt pounds and trigger fat-burning. getting plenty of exercise every week. Additional reporting by. Here's a newsflash: Feeling fat bears almost no relation to actually being fat. I'm going to have to run for 2 hours tomorrow so I can feel good again. How do I know if I have visceral fat? How can I reduce visceral fat getting enough sleep. Resources and support. For more information and support. That may be because you are not getting the right nutrients you need from your diet. Fat is stored throughout the body and that it produces chemicals and. Trans fat: Trans fat makes you fatter than other foods with the same According to the latest research, not getting enough sleep impairs your fat. Stream I Got This Fat Girl Fetish by DJ Refreshing Beverage on desktop and mobile. Play over million tracks for free on SoundCloud. Let's talk about how I got so fat. My body and weight has changed a lot in the last 8 years. How did I end up morbidly obese? The number on the scale is going up because your body is working hard, not because you are truly putting on fat. This is another one that feels counterintuitive. got less than 10 hours of sleep were 76% more likely to have overweight or obesity, while each additional hour of sleep reduced the likelihood by 21%. 3. All these “miracle” diets are supposed to help you melt pounds and trigger fat-burning. getting plenty of exercise every week. Additional reporting by. Here's a newsflash: Feeling fat bears almost no relation to actually being fat. I'm going to have to run for 2 hours tomorrow so I can feel good again.

I have been obsessed with weight loss. I've lived with and recovered from an He was still livid when he got home. He decided to stage a 'sit in' in. HOW I GOT FAT. M views · 6 years ago more. Sara Forsberg. M I Have A Confession. Sara Forsberg•K views · · Go to channel. Man boobs are caused by excess fat storage in the chest area, or as a result of a condition known as gynecomastia, which is a hormonal imbalance. Early-stage NAFLD does not usually cause any harm, but it can lead to serious liver damage, including cirrhosis, if it gets worse. Having high levels of fat in. I HAVE BEEN DOCUMENTING IT!! I don't know why that was all in caps Why I Gained So Much Weight (GOT FAT) + Trying on all of my old "SKINNY". There are many reasons why people gain belly fat, including poor diet, lack of exercise, and stress. Improving nutrition, increasing activity, and making other. weight management, weight and mind, fat. “Didn't you look in the mirror and see that you were getting fatter?” “And. Now I'm gaining weight. What's going on? Gaining weight after starting a Do I have to watch how much fat I eat? Fat isn't bad for you; it's a. After treatment, most people have some swelling, bruising, or discomfort. These are temporary. After getting the injections to dissolve excess chin fat, the. Medically, people who have a BMI in the healthy range but carry excess belly fat are considered to have normal-weight obesity. The CDC recommends getting. If you dread hearing your thighs clap when out for a jog or are unhappy that your jeans do not fit, the excess thigh fat around your legs is likely to blame. To burn calories and body fat efficiently, you're going to have to incorporate a workout regimen that involves back exercises. This involves resistance training. HOW I GOT FAT. M views · 6 years ago more. Sara Forsberg. M I Have A Confession. Sara Forsberg•K views · · Go to channel. If you do gain weight, however, the remaining fat cells can become larger. got on with life. These days, your cramps are more painful than ever — and. Getting diagnosed with lipedema can often be time-consuming and challenging. If you're not sure whether you have lipedema fat or you're overweight. Fat stored around your belly is known as 'visceral fat'. This type of fat Getting good sleep and limiting alcohol are also important. Poor sleep is. Just like body fat, face fat can occur due to several reasons. Usually, overweight people have large, chubby cheeks. But if you're skinny, you know that weight. If you feel like you just can't lose belly fat after 40, I've got you covered in this article. I have never had a great waist because of my natural shape. I. Hyperthermic Laser Liposuction – which is better? Getting rid of stubborn pockets of fat I have been really please with my treatment. Staff are very. Man boobs are caused by excess fat storage in the chest area, or as a result of a condition known as gynecomastia, which is a hormonal imbalance.

Used Car Rate

Vehicle Loan Rates ; New Auto Loans (Current or Upcoming Model Year with less than 6, miles) · & Newer · %, % · $ ; Used Auto Loans · &. Your interest rate and monthly payments will depend on your credit, your income, and your vehicle preference. Interest rates on new vehicles are often lower. Navy Federal offers competitive auto loan rates for new and used vehicles. See how much money you could save on new or used car financing today. Today's auto rates ; New & used car loans. month · % · about New & used car loansmonth ; New & used car loans. month · % · about New & used car. The average interest rates on used cars in fell between % to % depending on credit score. In , the average rates were % to %. Example auto loan payment: % APR for 36 monthly payments is approximately $ per $1, borrowed. View All Rates. Resources. In the first quarter of , the overall average auto loan interest rate was % for new cars and % for used cars. Experian also provides average car. Not ready to apply? Start a prequalification ; New car (dealer). % APR ; Used car (dealer). % APR ; Buy out your lease. % APR. Fast Application, Competitive Rates And Quick Decisions. Apply for a new or used car loan or refinance your existing auto loan at Bank of America. Vehicle Loan Rates ; New Auto Loans (Current or Upcoming Model Year with less than 6, miles) · & Newer · %, % · $ ; Used Auto Loans · &. Your interest rate and monthly payments will depend on your credit, your income, and your vehicle preference. Interest rates on new vehicles are often lower. Navy Federal offers competitive auto loan rates for new and used vehicles. See how much money you could save on new or used car financing today. Today's auto rates ; New & used car loans. month · % · about New & used car loansmonth ; New & used car loans. month · % · about New & used car. The average interest rates on used cars in fell between % to % depending on credit score. In , the average rates were % to %. Example auto loan payment: % APR for 36 monthly payments is approximately $ per $1, borrowed. View All Rates. Resources. In the first quarter of , the overall average auto loan interest rate was % for new cars and % for used cars. Experian also provides average car. Not ready to apply? Start a prequalification ; New car (dealer). % APR ; Used car (dealer). % APR ; Buy out your lease. % APR. Fast Application, Competitive Rates And Quick Decisions. Apply for a new or used car loan or refinance your existing auto loan at Bank of America.

Used Car (dealer) Payment Example: A 36 month used auto loan (model years to ) with an annual percentage rate (APR) of % would have monthly. ** APR = Annual Percentage Rate. Rates as low as % APR for terms up to 66 months on used auto loans. For each $10, borrowed over a term of 66 months, pay. Find the best rates on auto loans with PenFed Car Buying Service. Apply for a used and new car loan that's within your budget and lower your monthly. Rates are 1% higher without AutoPay; maximum % APR. “New Auto and Truck” means the current and prior model year with less than 10, miles. “Used Auto and. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. These rates are available only for new and used car, truck and motorcycle loans. Your APR will be determined based on creditworthiness, length and amount of. Auto, Motorcycle, RV and Boat Loan Rates ; New & Used Auto (see additional details and disclosures below), 0 to 60 Months 61 to 84 Months, % APR % APR. Current vehicle loan rates ; Includes cars, pickup trucks, SUVs, etc. New · 72 Month (6-year) ; Includes cars, pickup trucks, SUVs, etc. · years old, 60 Month . Auto Loan Rates as Low as % APR for New Vehicles You could get a decision in seconds, plus a discount for active duty and retired military. Whether you'. Best Auto Loan Rates & Financing in Compare Lenders ; LightStream - Used car purchase loan. · % · $5,$, · ; Consumers Credit Union. Apply for a new or used car loan with car financing from PNC Bank. Use our auto loan calculator to check current rates. Compare car loans from multiple lenders to find the best rate. New Car Purchase, Used Car Purchase, Refinance, Lease Buy Out. Auto Loan Type. See Personalized. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. Our Rates ; New Automobiles ( and Newer) · 48 Months, % ; Used Automobiles · 66 Months, % ; Motorcycles · 66 Months, %. Let us do the shopping for you. Get discounted pricing and our best rates on your next vehicle purchase in partnership with TrueCar. Rates starting at % APR. Auto Loans ; New & Used Motorcycle Loan, months, % ; New & Used Recreational Vehicle Loan, months, % ; New & Used Recreational Vehicle Loan · Research our new and used auto loans for your next car, truck, or SUV purchase. Whether you're looking to purchase a new or pre-owned vehicle or refinance your. At Credit Union ONE, we're geared up to offer great auto loan rates that can help you finance your next new or used car in MI. See our rates and apply now. See current PSECU car loan rates. Use the PSECU car loan calculator to estimate a payment. Explore the latest PSECU new car loan and used car loan options. Used-car loan rates start at % APR: choose a 3-year loan or 7-year financing and get the same low rate.

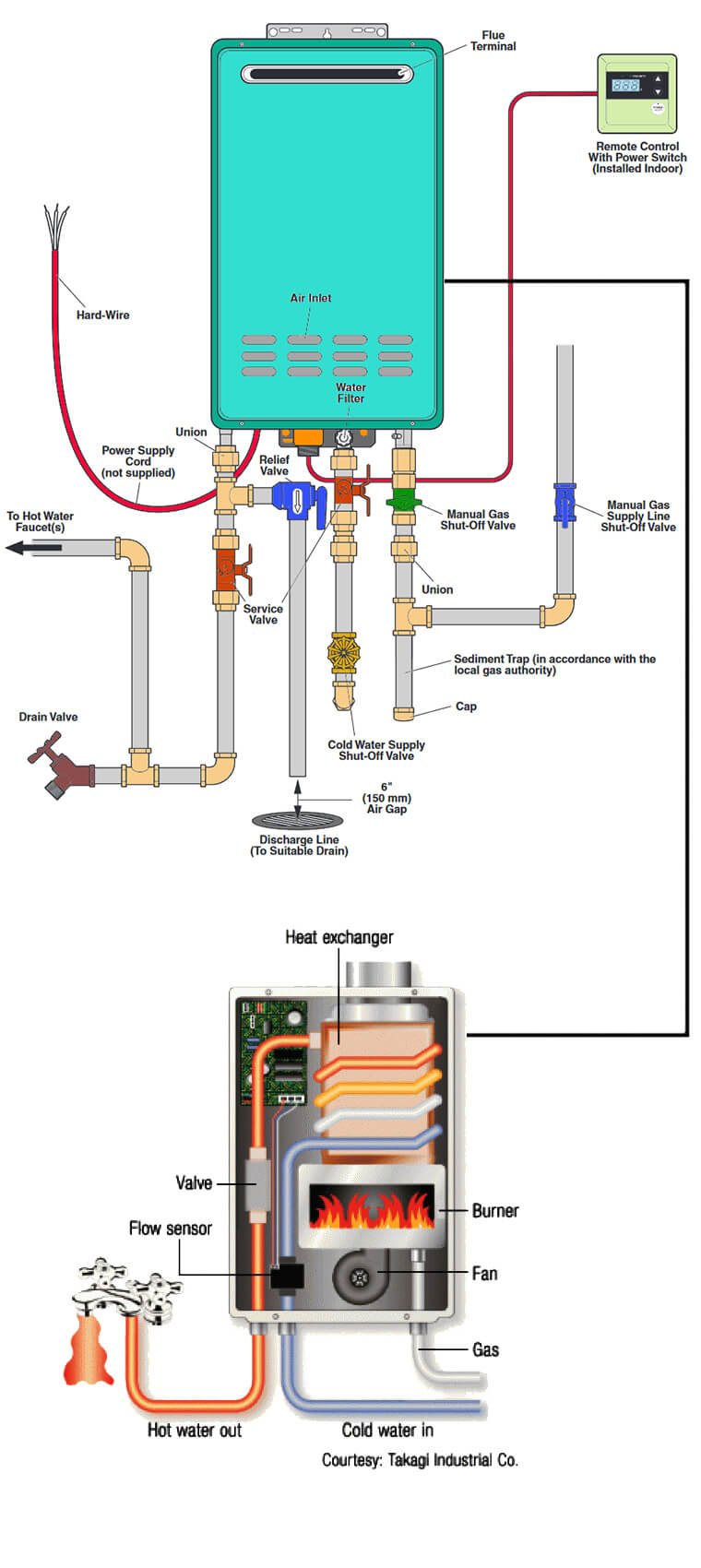

Do Tankless Hot Water Heaters Work

In fact, tankless electric water heaters can achieve a thermal efficiency rating of 99 percent, meaning that 99 percent of the electricity that goes into the. The concept behind the tankless water heater is to heat water when activated, by you, to do so. You activate the heating process when you turn on your faucet. Pros: Energy efficient, endless hot water supply, takes up less space. Cons: Higher upfront cost, may require upgrades to gas lines or. Electric tankless water heaters operate using electrical resistance heating coils to heat water on demand. These heaters are highly energy-efficient, converting. Tankless heaters are the exact opposite. Instead of heating water over time, water is heated more-or-less instantly. That means there's no need for a tank and. A tankless water heater, also known as an on-demand or instant water heater, is a type of water heater that heats water directly as it flows through the unit. Typically, tankless water heaters provide hot water at a rate of 2–5 gallons (– liters) per minute. Gas-fired tankless water heaters produce higher flow. With tankless water heaters, water is heated only on demand. This means that water is only heated when you actually need hot water. The tankless unit does this. Tankless water heaters work by using an electric element or gas burner. The power source warms the water as it travels through a pipe to the unit. In fact, tankless electric water heaters can achieve a thermal efficiency rating of 99 percent, meaning that 99 percent of the electricity that goes into the. The concept behind the tankless water heater is to heat water when activated, by you, to do so. You activate the heating process when you turn on your faucet. Pros: Energy efficient, endless hot water supply, takes up less space. Cons: Higher upfront cost, may require upgrades to gas lines or. Electric tankless water heaters operate using electrical resistance heating coils to heat water on demand. These heaters are highly energy-efficient, converting. Tankless heaters are the exact opposite. Instead of heating water over time, water is heated more-or-less instantly. That means there's no need for a tank and. A tankless water heater, also known as an on-demand or instant water heater, is a type of water heater that heats water directly as it flows through the unit. Typically, tankless water heaters provide hot water at a rate of 2–5 gallons (– liters) per minute. Gas-fired tankless water heaters produce higher flow. With tankless water heaters, water is heated only on demand. This means that water is only heated when you actually need hot water. The tankless unit does this. Tankless water heaters work by using an electric element or gas burner. The power source warms the water as it travels through a pipe to the unit.

Also known as an on-demand water heater, tankless water heaters revolutionize hot water delivery by heating water instantly as it flows through the unit. Unlike. A flow sensor detects when you turn on a hot water faucet and activates the tankless water heater. A series of heating elements then heat the water and will. A tankless water heater, on the other hand, is designed to heat water on demand, meaning that you'll have access to a virtually unlimited amount of hot water. Tankless electric water heaters eliminate Stand-by Loss and Cycling Loss. They only heat the hot water as demanded, reducing water heating costs by up to 60%. Tankless water heaters are usually powered with electricity or gas. These types of water heaters were found to be 22 percent more energy efficient on average. In order to provide on-demand, continuous hot water, tankless units use heat exchangers with many small passageways consisting of parallel plates or tubes. This. Because there's no tank, it doesn't work off of capacity; it works off demand. A tankless water heater heats up water as you need it, and it brings hot water to. Once the demand for hot water no longer exists, the tankless water heater automatically shuts down and stops using energy. Now you get to enjoy energy savings. How does a tankless water heater work? Unheated water in a tankless system flows across a heat exchanger, which is itself heated by combustion. Heat is. Tankless water heaters heat water while it flows through pipes instead of storing hot water for later use. Tankless water heaters warm water on demand, so you never run out of hot water. They're also energy efficient, which saves you money on utility bills. An ENERGY STAR certified gas tankless water heater uses a secondary heat exchanger to use 9 percent less energy than a conventional gas tankless water heater. Choosing a tankless water heater with an IID is a way to help you reduce the amount of gas your tankless water heater uses, so the flame only kicks on when you. Electric tankless water heaters use electrical resistance heating coils to heat the water. As the cold water flows over these coils, it gets rapidly heated, and. Energy Efficiency: Tankless units only heat water when needed, reducing standby heat loss and conserving energy. · Unlimited Hot Water: Tankless water heaters. Tankless water heaters can be an efficient, economical option for many homeowners. Overall, natural gas tankless water heaters are the choice for greater water. Tankless water heaters only provide hot water as needed. You might also hear them referred to as “demand-type” or “instantaneous” water heaters. How the Tankless Water Heater Works Unlike traditional water heaters, which hold hot water in a tank, tankless water heaters don't store hot water. Instead. Electric tankless water heaters do work in cold climates, but colder climates lead to colder incoming groundwater temperature. This results in the need for more. Tankless water heaters run on energy either from gas, propane, or electricity. When the tap is turned on, the cold water flows through the unit inside the.

How To Find The Value Of The Annuity

The calculation of an annuity follows a formula: Future Value of an Annuity =C (((1+i)^n - 1)/i), where C is the regular payment, i is. This present value of an annuity calculator calculates today's value of a future cash flow. The annuity may be either an ordinary annuity or an annuity due. Free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. It is possible to calculate the future value of an annuity due by hand. To do this, you could make a chart to list the amounts of the payments being made. You. This is the sum of the present values of all the payments received in an annuity. It relies on the concept of the time value of money. This calculator can tell you the present value of your savings. First enter the amount of the payment that you've been making, the account's interest rate. The present value of an annuity is the cash value of all future payments given a set discount rate. It's based on the time value of money. The present value (PV) of an annuity is the total worth of all future annuity payments in terms of today's money. Use Bankrate's annuity calculator to calculate the number of years your investment will generate payments at your specified return. The calculation of an annuity follows a formula: Future Value of an Annuity =C (((1+i)^n - 1)/i), where C is the regular payment, i is. This present value of an annuity calculator calculates today's value of a future cash flow. The annuity may be either an ordinary annuity or an annuity due. Free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. It is possible to calculate the future value of an annuity due by hand. To do this, you could make a chart to list the amounts of the payments being made. You. This is the sum of the present values of all the payments received in an annuity. It relies on the concept of the time value of money. This calculator can tell you the present value of your savings. First enter the amount of the payment that you've been making, the account's interest rate. The present value of an annuity is the cash value of all future payments given a set discount rate. It's based on the time value of money. The present value (PV) of an annuity is the total worth of all future annuity payments in terms of today's money. Use Bankrate's annuity calculator to calculate the number of years your investment will generate payments at your specified return.

The present value of an annuity chart reflects the current value of the future stream of payments, considering the time value of money. To calculate the present value of an annuity, you need to add up all the present values of each annuity. To discover the present value of each payment, you have. In case of Monthly Annuity 1. Find the Monthly Compounding Factor, as (1+(r/) 2. Divide the ordinary Annuity by t 3. he Monthly factor. P = Value of each payment; r = Rate of interest per period in decimal; n = Number of periods. Ordinary Annuity Formula. Solved Examples Using Ordinary. Use this calculator to find the present value of annuities due, ordinary regular annuities, growing annuities and perpetuities. This calculator gives the present value of an annuity (ordinary /immediate or annuity due). Find out everything you need to know about calculating the present value of an annuity and the future value of an annuity with our helpful guide. Calculate the future value of an annuity due, ordinary annuity and growing annuities with optional compounding and payment frequency. Annuity formulas and. This is the sum of the present values of all the payments received in an annuity. It relies on the concept of the time value of money. I don't know how to calculate this annuity into my net worth. It's an asset, correct? My advisor blew me off when I asked about this. The calculation of an annuity follows a formula: Future Value of an Annuity =C (((1+i)^n - 1)/i), where C is the regular payment, i is. The Present Value of Annuity Calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of. The present value of an annuity tells you what your future payments are worth. Learn the net present value formula and calculation! Calculating Present and Future Values Using PV, NPV, and FV Functions in Microsoft Excel · Rate = Discount rate or interest rate in decimal form. · Number of. The present value of an annuity due is calculated using a similar formula as a standard annuity, but you multiply the final result by (1 + r) due to the. What is the formula for present value of annuity due? The present value of an annuity due is P_n = R1- (1+i)^(-n)(1+i)/i. Here, R is the size of the regular. It is only possible to calculate with certainty the value of a fixed-rate annuity. By definition, the payments made by variable annuities and indexed annuities. The formula looks like this: PV = PMT x [(1 - (1 / (1 + r)n)) / r], where PV is the present value, PMT is the payment amount, r is the interest rate per period. What is the Formula to Calculate Annuity in Present Value and Future Value? · P = Value of each payment · r = Rate of interest per period in decimal · n = Number. Using the PVOA equation, we can calculate the interest rate (i) needed to discount a series of equal payments back to the present value.

Property Inspection Cost

You can expect the home inspection cost to be between $ and $ It could be higher depending on the location and size of the property. After. Your average home inspection costs in Maryland is $ However, your average home inspection price ranges between $ and $ based on the size, type. Home inspections typically cost $ – $, but the final cost depends on factors like the size of the home. Learn more about budgeting for a home. The Average Cost of Home Inspection Per Square Feet are as Following: · $ for 4,+ sq ft. · $ for 2, sq ft. · $ for 2, – 4, sq ft. · $ Inspection Cost · Condo/Townhome: starting at $ · Single Family Home: starting at $ (up to 2, sq ft) · Multi-Family Home ( units): call for pricing. On average, you can expect to pay around $ for a straightforward home inspection in the Tampa area. However, the cost of a home inspection can vary widely. The average home inspection costs $$ Factors such as home size, the age of the home, location and required expertise all influence the price of. Property inspection fees from a certified professional home inspector generally start just above $ Aside from the time invested, the value of the inspection. On average, a general home inspection in New York City can cost anywhere between $ and $, depending on the factors mentioned earlier. This type of. You can expect the home inspection cost to be between $ and $ It could be higher depending on the location and size of the property. After. Your average home inspection costs in Maryland is $ However, your average home inspection price ranges between $ and $ based on the size, type. Home inspections typically cost $ – $, but the final cost depends on factors like the size of the home. Learn more about budgeting for a home. The Average Cost of Home Inspection Per Square Feet are as Following: · $ for 4,+ sq ft. · $ for 2, sq ft. · $ for 2, – 4, sq ft. · $ Inspection Cost · Condo/Townhome: starting at $ · Single Family Home: starting at $ (up to 2, sq ft) · Multi-Family Home ( units): call for pricing. On average, you can expect to pay around $ for a straightforward home inspection in the Tampa area. However, the cost of a home inspection can vary widely. The average home inspection costs $$ Factors such as home size, the age of the home, location and required expertise all influence the price of. Property inspection fees from a certified professional home inspector generally start just above $ Aside from the time invested, the value of the inspection. On average, a general home inspection in New York City can cost anywhere between $ and $, depending on the factors mentioned earlier. This type of.

There is no set charge for a home inspection, but as you might expect, you'll pay more for larger homes because it's more work to tour the property. For condos. It typically depends on several variables. The first being the experience level of the home inspector. New to the industry inspectors are naturally going to. Home Advisor states that an average home inspection of a condo or home under square feet costs around $ while homes over 2, square feet costing over. Kansas REI Home Inspection Pricing For Wichita · 0 – $ · 1, – 2, $ · 2, – 2, $ · 3, – 3, $ · 3, – 3, $ The average cost of a home inspection can vary, typically from $ to $1, or more, depending on various factors such as property size. A home inspection will typically cost you between $ – $1, Location, size and age of the home will impact the price. You might be overwhelmed by the. Bennett Property Inspection | High Quality Home Inspections. Our average cost of a full service home inspection on a sf home is less than $ Far less. The average cost of home inspection is $ Costs vary depending on the region, size and age of the house, scope of services, and other factors. Pricing ; Services, Price With a Home Inspection, Price Without a Home Inspection ; "ASHI" Whole House Inspection under Sq. Ft. $, n/a ; Central Illinois Property Inspection Cost & Pricing: · $ · $ · $ · $ · $ · $ · Call Us. These include a percentage of the sale price, your hourly rate, the cost per some ratio of square footage, or a flat fee based on the type of building. Other. A typical home inspection costs $, but that could be lower or higher, depending on how big and how old the home is. The true average cost of a home inspection is about $ more than $, so about $ However, depending on your state, this can be higher. Why you may ask? Our pricing is $ total for homes up to 3, square feet and $ per square foot for homes over 3, square feet. It doesn't matter whether the home was. Home inspections in Spokane and Washington state typically cost between $ and $ This is slightly more than the average cost across the United States. The average cost of a home inspection is between $ and $, and that's for the bare-bones visual home inspection. If you want to have your potential new. The price of a home inspection depends on the size and type of house and the location. On average, homeowners spend between $ and $ Based on our survey, for the average 3 bed, 2 bath US Home of sf, (with no additional services) you should expect to pay around $ for a home inspection. Home inspections in the United States typically cost between $ and $ If the home includes additional features such as a septic system, barns, or private. There are inspectors who may charge as little as $, no matter the size of the house or how complicated it is to inspect.

Average Motorcycle Insurance Cost Florida

If you're an experienced rider, you may pay around $ per year for motorcycle insurance. The price can vary based on where you live within the Sunshine State. Start Your Quote. brightway-side-icon. Coverage. Typical Lakeland Motorcycle Coverage. By understanding your unique riding needs, including those for dirt bikes. Every place I've quoted has been upwards of $/month and that's with medium coverage Not even covering the bike itself. The average annual motorcycle insurance premium in the U.S. is $, with significant variations depending on the rider's state, age, bike type, and coverage. Deerfield Beach and Pompano Beach bikers: Protect your ride with a motorcycle insurance policy from Automatic Insurance. Get a quote today! Your premium for motorcycle insurance will depend on many factors. Where you live, your driving record, the type of motorcycle, and how much your bike costs to. $10, in bodily injury liability per person · $10, in guest passenger (limits must be equal to bodily injury, if selected) · $10, for property damage. Get Florida motorcycle insurance quotes, cost & coverage fast. Find The average price of bike insurance varies widely based on certain factors. In , the annual cost for a Progressive motorcycle policy in Florida with liability coverage was only $ Many factors determine your policy's rate. If you're an experienced rider, you may pay around $ per year for motorcycle insurance. The price can vary based on where you live within the Sunshine State. Start Your Quote. brightway-side-icon. Coverage. Typical Lakeland Motorcycle Coverage. By understanding your unique riding needs, including those for dirt bikes. Every place I've quoted has been upwards of $/month and that's with medium coverage Not even covering the bike itself. The average annual motorcycle insurance premium in the U.S. is $, with significant variations depending on the rider's state, age, bike type, and coverage. Deerfield Beach and Pompano Beach bikers: Protect your ride with a motorcycle insurance policy from Automatic Insurance. Get a quote today! Your premium for motorcycle insurance will depend on many factors. Where you live, your driving record, the type of motorcycle, and how much your bike costs to. $10, in bodily injury liability per person · $10, in guest passenger (limits must be equal to bodily injury, if selected) · $10, for property damage. Get Florida motorcycle insurance quotes, cost & coverage fast. Find The average price of bike insurance varies widely based on certain factors. In , the annual cost for a Progressive motorcycle policy in Florida with liability coverage was only $ Many factors determine your policy's rate.

Dairyland offers different types of motorcycle insurance coverage options based on your needs. Typical coverages include: Collision. Comprehensive. In fact, motorcyclists may be able to obtain insurance in Florida for as low as $52 dollars a month, with the average cost being around $80 per month (or less. Progressive motorcycle insurance offers full replacement cost coverage for Florida) require motorcycle insurance before you can legally register your bike. Get the motorcycle insurance coverage you need at USAA Insurance Agency. Get a quote today and make sure that you and your bike are protected. The cost of motorcycle insurance in the United States is estimated to be $60 per month or $ per year on average. In California, the average monthly cost for motorbike insurance is $, according to an article made by Forbes. Get a free motorcycle insurance quote to see how much you could save with our discounts. Customize your motorcycle coverage and only pay for what you need. On average, minimum-coverage motorcycle insurance costs $68 per month, while full coverage is $ per month. Minimum Motorcycle Insurance Coverage in Florida · $10, in bodily injury liability for one injury victim · $20, in bodily injury liability for two or more. Florida Motorcycle Insurance Coverage Requirements · $10, bodily injury liability coverage per person · $20, bodily injury liability coverage per accident. If you're wondering about the cost, here's the short answer: Motorcycle insurance premiums with Progressive in Florida can range from $ to $ per year. On average, it costs $85 a month to insure a Florida motorcycle. This amounts to an average annual insurance cost of $ Get motorcycle insurance for all brands from a company that knows motorcycles. Insurance policies as low as $6/month. Get a quote in minutes! Florida Motorcycle Insurance: Cost, Laws, and More. Insurance companies in Florida may charge anywhere between $$ per year for motorcycle insurance. We can help you find affordable motorcycle insurance rates and great coverage no matter what type of bike you have. The average cost of a dirt bike policy in the United States is around $99 per year. That price will typically go up for an year-old but may still be lower. Florida – $ States with the Lowest Average Cost of Motorcycle Insurance. All five states with cheap motorcycle insurance prices had premiums that were at. Golf cart insurance can cost as little as $75 per year in Florida. The insurance company you choose, modifications to your golf cart that change how it is. Motorcycle insurance was designed to protect your bike and you. A standard motorcycle policy will typically cover: Bodily injury liability coverage. Insure it to fit your needs. Save up to 60% by switching your insurance to VOOM. Motorcycle Insurance. Get a Quote. Learn more. Rideshare Insurance.

1 2 3 4 5 6