30h4.site Learn

Learn

5 Year Certificate

You can open a Certificate with a minimum of $, or $ if you're under 25; There are flexible terms, from 6 months to 5 years; You'll earn dividends monthly. CDs come in a variety of terms from 3-, 6-, or months to 4-, 5-, and even year terms. Learn more about how CDs work and about the advantages and. ECE Five Year Certificate: ECEs renewing their Five Year Certificate must show proof of meeting the required work experience hours, and confirm that they have. A Certificate of Deposit is a savings option that grows steadily, great We offer terms from 3 months to 5 years • Longer terms offer potentially. With America First, you can create certificate accounts that last anywhere between three months to five years, and they deliver dividends worth celebrating. A certificate of deposit (CD) is a low-risk savings To build a CD ladder, he invests $2, each in a 1-year, 2-year, 3-year, 4-year and 5-year CD. Celebrate a milestone of dedication and commitment with our "05 Years of Service" certificate template. This Microsoft Word template is a heartfelt way to. Green Term Certificate · Help fund eco-friendly initiatives · Increased rates on longer terms · Terms from 3 months to 5 years. A certified ECE with the Basic Certificate is able to work alone and/or as the primary educator in a child care setting for children 3 to 5 years of age, and. You can open a Certificate with a minimum of $, or $ if you're under 25; There are flexible terms, from 6 months to 5 years; You'll earn dividends monthly. CDs come in a variety of terms from 3-, 6-, or months to 4-, 5-, and even year terms. Learn more about how CDs work and about the advantages and. ECE Five Year Certificate: ECEs renewing their Five Year Certificate must show proof of meeting the required work experience hours, and confirm that they have. A Certificate of Deposit is a savings option that grows steadily, great We offer terms from 3 months to 5 years • Longer terms offer potentially. With America First, you can create certificate accounts that last anywhere between three months to five years, and they deliver dividends worth celebrating. A certificate of deposit (CD) is a low-risk savings To build a CD ladder, he invests $2, each in a 1-year, 2-year, 3-year, 4-year and 5-year CD. Celebrate a milestone of dedication and commitment with our "05 Years of Service" certificate template. This Microsoft Word template is a heartfelt way to. Green Term Certificate · Help fund eco-friendly initiatives · Increased rates on longer terms · Terms from 3 months to 5 years. A certified ECE with the Basic Certificate is able to work alone and/or as the primary educator in a child care setting for children 3 to 5 years of age, and.

Flexible terms to fit your needs, from 6 months to 5 years. How certificate accounts work. A Certificate is like a promise. You agree to leave your money. With fixed interest rates and terms ranging from 6 months to 5 years, our CD accounts are a great way to save money you don't need right away. Start saving for tomorrow–and beyond–today with a Webster Bank CD. We offer terms ranging from 30 days to five years, delivered by your own single-point-of-. 5 year online CDs. % Annual Percentage Yield (APY). CD ACCOUNT As of 9/2/, the advertised annual percentage yield (APY) for each certificate. The best 5-year CD rate is % APY from Pima Federal Credit Union. To find you the highest 5-year CD rates nationwide, we review CD rates from hundreds of. Early Withdrawal Penalties shown apply to new CDs. less than 1 year. 1 year to 5 years. 5 years to. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is often higher than a traditional. 5 Year. %. 7 Year. %. *Annual Percentage Yield $1, minimum amount to What's the difference between a Certificate and a Certificate of Deposit (CD)?. A certificate of deposit, or CD, is a type of savings account that holds a fixed amount of money for a fixed period of time, typically ranging anywhere from. Advertised interest rate of % (% Annual Percentage Yield (APY)) is for a new 5-month certificate of deposit (CD) with balances of $ or more. CD. 5-year CD average: percent APY. When you're in the market for a new CD and a yield curve inversion is in place, it's important to look at all CD terms. 5 Years, %, %, %. 7 Years, %, %, %. Rates as of Sep 02, Certificate for the remainder of the certificate's term. At maturity. Buying a CD in 5 Easy Steps. Opens in popupRead transcript. What is a 6 Month CDs, 9 Month CDs, 1 Year CDs, 18 Month CDs, 2 Year CDs. Rates up to, Enjoy earning a fixed interest rate for the term you select, from 3 months to 5 years. Annual Percentage Yields (APYs) are accurate as of 08/30/ 1 year. Standard Fixed Rate. Balance. Standard Interest Rate. Annual Percentage Yield (APY) 5. Terms and conditions apply. Mobile carrier's message and. Quontic's CDs shine with top rates across terms from six months to five years, and the opening minimum of $ is relatively low compared to other online banks. Consider this example of opening five $5, certificate accounts instead of one $25, certificate account: Year One: Open 5 certificate accounts, each. This bank's CD stands out with an APY of %. While most 5-year certificates average around 2%, the fact that Federal Savings Bank more than doubles it makes. Annual Percentage Yield, or APY, is the total interest earned over the course of the year. This is different from the interest rate as it includes. Certificate investments: The FDIC backs banks, and the NCUA backs credit unions. CDs and Certificates have fixed terms, often from one year to five years.

Can You Open More Than One Checking Account

:max_bytes(150000):strip_icc()/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-cbf2392d68a44e7484e66859449cc47c.jpg)

Having multiple accounts in a savings portfolio along with a checking account can get confusing but keeping your accounts at the same bank can provide. Establishing both your savings account and your checking account at the same bank makes it very easy to transfer money between the two. You can also add a. The reason you need at least two checking accounts at two different banks is in case Chase kicks you to the curb and closes your account. Mobile and online banking offers more than 24/7 access to your accounts. You can: Deposit checks (mobile only); Transfer money electronically between accounts. Currently, each Bluevine Business Checking account can have up to 5 sub-accounts. That means that you can have up to 6 active Bluevine checking accounts. Who. $3 monthly service charge waived if more than $10, on deposit. If How to select, open, and use a checking account; Understanding the fees. Yes, it is legal to open up multiple bank accounts in the US. Many people in the US have both a Checking and Savings account with one bank. How many checking accounts should you have? This is truly up to you. Some people prefer to have one checking account and multiple deposit accounts; others. There are no laws against having more than one business bank account and the pros out weigh the cons. Having multiple accounts in a savings portfolio along with a checking account can get confusing but keeping your accounts at the same bank can provide. Establishing both your savings account and your checking account at the same bank makes it very easy to transfer money between the two. You can also add a. The reason you need at least two checking accounts at two different banks is in case Chase kicks you to the curb and closes your account. Mobile and online banking offers more than 24/7 access to your accounts. You can: Deposit checks (mobile only); Transfer money electronically between accounts. Currently, each Bluevine Business Checking account can have up to 5 sub-accounts. That means that you can have up to 6 active Bluevine checking accounts. Who. $3 monthly service charge waived if more than $10, on deposit. If How to select, open, and use a checking account; Understanding the fees. Yes, it is legal to open up multiple bank accounts in the US. Many people in the US have both a Checking and Savings account with one bank. How many checking accounts should you have? This is truly up to you. Some people prefer to have one checking account and multiple deposit accounts; others. There are no laws against having more than one business bank account and the pros out weigh the cons.

On the other hand, if you are prone to overdraft fees, then add a little cushion for yourself. Even with a cushion, Cole recommends keeping no more than two. You will only receive one debit card for each account type listed above, even if you have multiple accounts. For example, if you have multiple Checking. A common strategy is to open a joint account as well as keeping separate accounts, then link them all. That allows you to maintain independent control of your. Bank where you matter ; Frost Personal Account. 8 · Access to direct deposits up to two days earlier · Bank anytime with our mobile app ; Frost Plus Account. Can you get in trouble for having multiple bank accounts? How many bank accounts can you have? There is no limit on the number of bank accounts, whether they'. Can I have multiple debit cards for my account? You can have one debit card, in your name, per checking or similar transactional account (such as a. Service charges waived if you achieve a combined total balance of at least $, across your deposit and investment accounts one time per month. Otherwise. If you're thinking about whether to have multiple bank accounts, keep this in mind: There's no single right or wrong answer. While there is no need to open five. None. And no overdraft related fees2 either. How can I avoid the $12 monthly maintenance fee? We give clients five different ways to waive the $12 Monthly. To open an individual account in your name only, you will need (1) a valid U.S. driver's license or U.S. non-driver's ID and (2) a valid U.S. Social Security. It's not bad to have multiple checking accounts open. In many cases, money experts suggest you have at least two accounts to help divide up your necessary and. Each account and type will need to be connected individually, but you can have both savings and checking accounts linked to your account at one time. The. Although you can have multiple chequing accounts, you'll only have one debit card, one monthly plan fee, and one 'lead' account (which you'll use to pay any. You may link up to 10 accounts to a single card. However, your designated checking account will fund non-Regions ATM transactions and purchases at Visa®. Select "joint account" when you fill out your application or, after you fill in one person's information, choose to add a co-applicant. Both people may need. Multiple accounts can make it easier to follow a monthly budget · By taking a modern-day approach to savings, you can update an old-fashioned method with all the. If qualifying account balances are not maintained, one or more of the you may no longer qualify for Comerica Platinum Circle Checking benefits. Can I have more than one supplemental savings account? Yes. You can have up to 19 supplemental savings accounts. What's the difference between a regular. Benefits of having multiple bank accounts · Organized spending: Easier to keep track of finances if you have separate accounts for personal and business expenses. With Early Pay Day, the Bank may make incoming electronic direct deposits made through the Automated Clearing House (ACH) available for use up to two days.

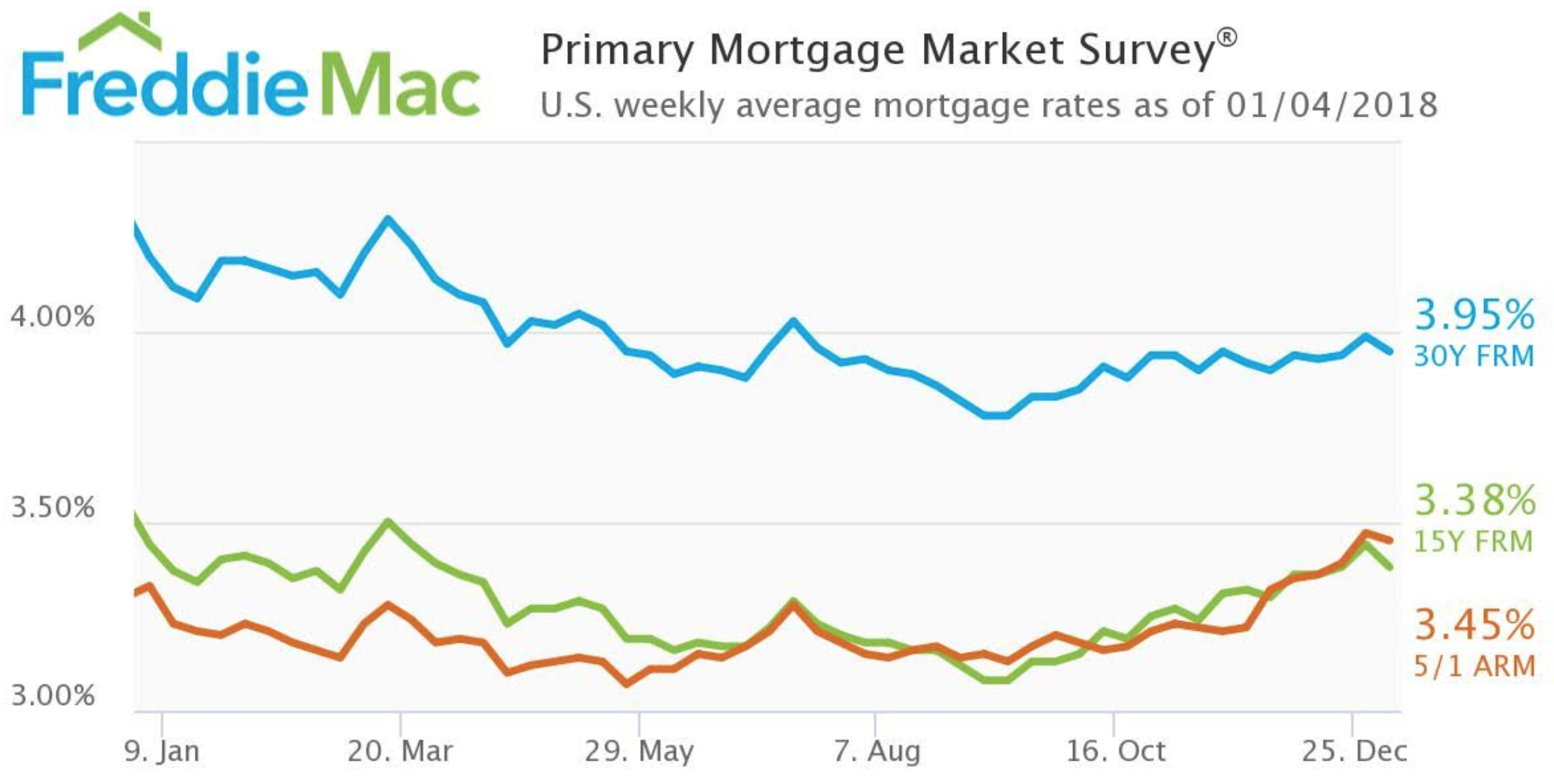

Freddie Mac Interest Rates

11, (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey (PMMS®), showing that the year fixed-. Guidelines for Using the Interest Rate ; July 15, - September 15, % ; June 14, - July 14, % ; May 14, - June 13, %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Related Categories. Mortgage Rates Interest Rates Money, Banking, & Finance Tags. Year Freddie Mac Fixed Mortgage Weekly Interest Rate Interest Rate. The average year fixed rate mortgage (FRM) fell from % on Aug. 22 to % on Aug. 29, according to Freddie Mac. “Mortgage rates fell again this week due. Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. Freddie Mac's Primary Mortgage Market Survey® compiles data each week on the rates and points on the most popular mortgage products from about U.S. lenders. “While rates increased slightly this week, they remain more than half a percent lower than the same time last year,” said Sam Khater, Freddie Mac's Chief. year fixed-rate mortgage averaged percent with an average point as of October 27, , up from last week when it averaged percent. A year ago. 11, (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey (PMMS®), showing that the year fixed-. Guidelines for Using the Interest Rate ; July 15, - September 15, % ; June 14, - July 14, % ; May 14, - June 13, %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Related Categories. Mortgage Rates Interest Rates Money, Banking, & Finance Tags. Year Freddie Mac Fixed Mortgage Weekly Interest Rate Interest Rate. The average year fixed rate mortgage (FRM) fell from % on Aug. 22 to % on Aug. 29, according to Freddie Mac. “Mortgage rates fell again this week due. Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. Freddie Mac's Primary Mortgage Market Survey® compiles data each week on the rates and points on the most popular mortgage products from about U.S. lenders. “While rates increased slightly this week, they remain more than half a percent lower than the same time last year,” said Sam Khater, Freddie Mac's Chief. year fixed-rate mortgage averaged percent with an average point as of October 27, , up from last week when it averaged percent. A year ago.

Mortgage rates and affordability ; %, $ 1, ; 7%, $ 1, ; %, $ 2, ; 8%, $2,

An investor gets a $3M loan. The rate of interest is % is being used for example purposes only (Note that at the time of this article rates are. interest rate that is the same as the first mortgage rate. The loan may also be used to pay closing costs. Highlights for HFA Advantage and HFA Advantage. Contact your lender, your financial advisor, and/or a housing counselor for advice or information related to your specific situation. My Home by Freddie Mac®. That makes the secondary mortgage market more liquid and helps lower the interest rates paid by homeowners and other mortgage borrowers. Fannie Mae and Freddie. Follow national average mortgage rates from Freddie Mac's Primary Mortgage Market Survey, conducted weekly. An investor gets a $3M loan. The rate of interest is % is being used for example purposes only (Note that at the time of this article rates are. Freddie Mac surveys lenders on the rates and points for their most popular year fixed-rate, year fixed-rate and 5/1 hybrid amortizing adjustable-rate. The interest rate a lender would charge to lend mortgage money to a qualified borrower exclusive of the fees and points required by the lender. This commitment. The Freddie Mac Primary Mortgage Market Survey surveys lenders weekly with results released each Thursday at 10 am EST. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The weekly mortgage rate is now based on applications submitted to Freddie Mac from lenders across the country. For more information regarding Freddie Mac's. year FHA loans: % with point (previous week: % with point). Mortgage Rate Trends, Past 3 Months. YR Fixed, interest rates and monthly payments. Report, Primary Mortgage Market Survey. Category, Interest Rates. Region, United States. Source, Freddie Mac. Stats. Last. Non-recourse · Highly competitive rates · Flexible terms and prepayment options · Streamlined process – faster closing times · Interest-only available · Up to 80%. Non-recourse · Highly competitive rates · Flexible terms and prepayment options · Streamlined process – faster closing times · Interest-only available · Up to 80%. Mortgage Rate Predictions for · Freddie Mac: Rates will remain elevated through most of · Fannie Mae: Rates will average % in Q3 and % in Q4. Average Rates, %, %. August 22, Yr FRM, Yr FRM. Average Rates, %, %. August 15, Yr FRM, Yr FRM. Average Rates, %. 27, (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey (PMMS®), showing the year fixed-rate. Freddie Mac, Year Fixed Rate Mortgage Interest Rates. Mortgage rates and affordability ; %, $ 1, ; 7%, $ 1, ; %, $ 2, ; 8%, $2,

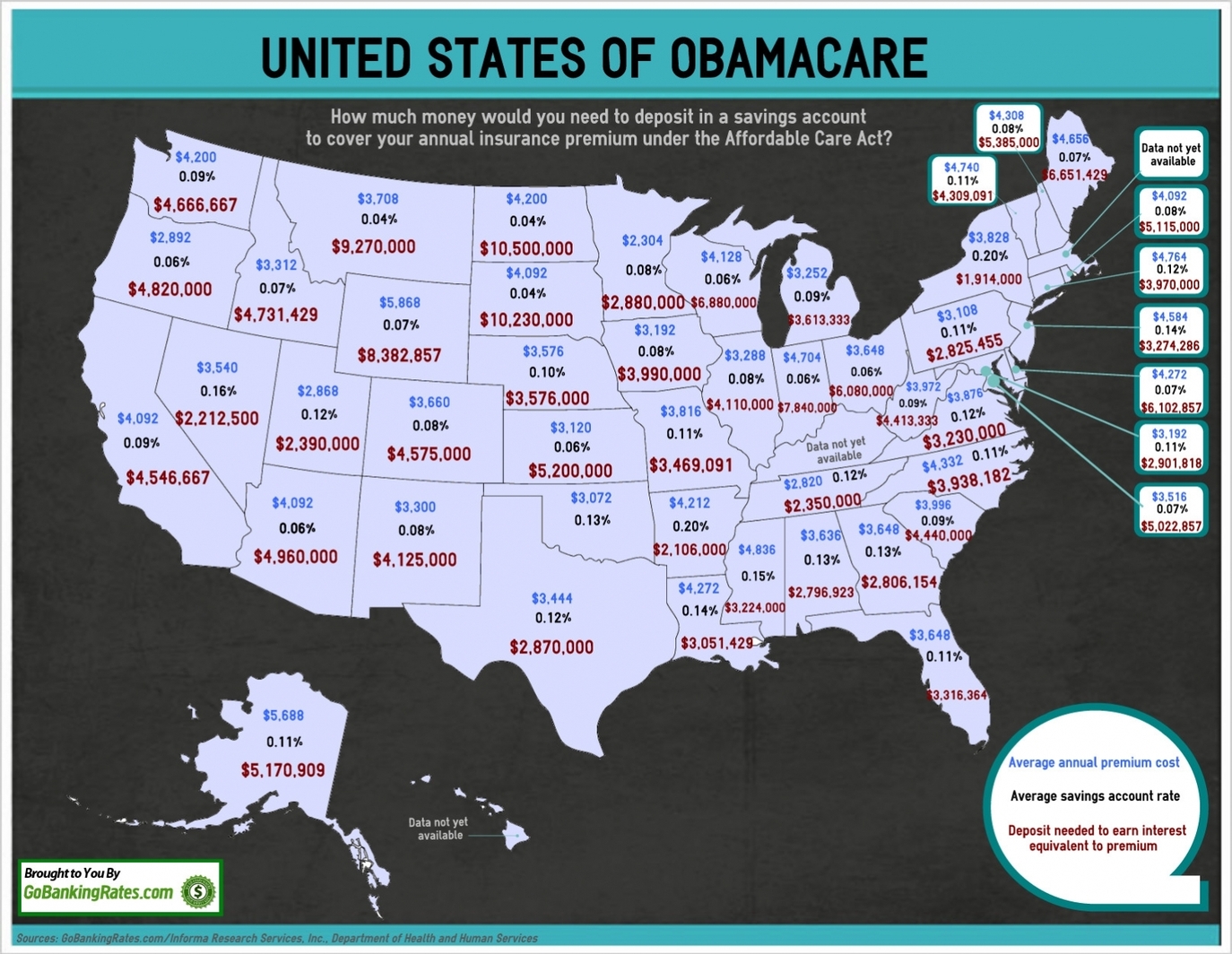

Obamacare Cost For Single Male

Premiums for individual health plans on and off the Marketplace are rated based on: Type of plan chosen. Each year, DIFS publishes the names of the insurers. Giving more people access to care through affordable coverage. Male and female unpacking after moving. Affordable care for members. With our Affordable Care. The average cost of an ACA plan is $/month before a subsidy, but again, depends on your household size and income. Insurers also vary by location. More info. In Massachusetts you have access to many types of health insurance plans, a choice of cost-sharing features and many different ways to buy a health plan. Learn about eligibility requirements for Washington Apple Health for individual adults. Learn more from Washington state Office of the Insurance Commissioner about local family and individual Exchange and non-Exchange health plans and premiums. If one's income is too high to qualify for a subsidy, then it costs exactly the same as a 'normal' plan on the regular individual market. An individual with an income of up to $87, and a family of four who makes up to $, can receive state subsidies to lower the costs of health coverage. The Affordable Care Act (ObamaCare) lowers costs based on income. Plans costs less than $ a month for the majority of Americans who qualify for. Premiums for individual health plans on and off the Marketplace are rated based on: Type of plan chosen. Each year, DIFS publishes the names of the insurers. Giving more people access to care through affordable coverage. Male and female unpacking after moving. Affordable care for members. With our Affordable Care. The average cost of an ACA plan is $/month before a subsidy, but again, depends on your household size and income. Insurers also vary by location. More info. In Massachusetts you have access to many types of health insurance plans, a choice of cost-sharing features and many different ways to buy a health plan. Learn about eligibility requirements for Washington Apple Health for individual adults. Learn more from Washington state Office of the Insurance Commissioner about local family and individual Exchange and non-Exchange health plans and premiums. If one's income is too high to qualify for a subsidy, then it costs exactly the same as a 'normal' plan on the regular individual market. An individual with an income of up to $87, and a family of four who makes up to $, can receive state subsidies to lower the costs of health coverage. The Affordable Care Act (ObamaCare) lowers costs based on income. Plans costs less than $ a month for the majority of Americans who qualify for.

Cost-Sharing Reductions · Financial Help FAQ. expand nav. Income Affordable Care Act (ACA) · Enhancements to the ACA · Insulin Safety Net Program. Provides consumer cost information on all individual health insurance plans offered through the Oregon Health Insurance Marketplace website and all. Want to save money on your health plan? The Affordable Care Act gives thousands of Arizonans financial help to lower their healthcare costs. Browse our plan. Highmark has you covered with plenty of low-cost plans to choose from. You can enroll in an Individual and Family plan during a Special Enrollment Period. If your income is low or you have certain life situations, you could qualify for free or low-cost coverage through Medicaid. Resources. About the Affordable. A silver plan is one type of plan available through both the state's marketplace and individual market outside the ACA marketplace. Plans offered in the. individual or $1, for a couple, are eligible for Medicaid through the “ACA Adult” category. This means Illinois Medicaid now provides health coverage for. The cost estimator will generate the estimated total cost for the year as well as the largest possible amount an individual may pay. Disclaimer:This tool is. There you will find information about purchasing major medical insurance, qualifying for free or low cost ACA Tax Provisions for Individuals and Families (IRS). Marylanders can purchase the exact same ACA (Affordable Care Act) compliant individual or family health insurance plans from Maryland Health Connection. You can share the cost of these premiums with your employees, if you wish. Lowest premiums for SHOP health insurance plans in each "metal" category. Individual monthly insurance costs range widely, from $12 for TRICARE to $1, for a year-old on a platinum ACA plan. For ACA plans, monthly premium. The 4 “metal” categories: There are 4 categories of health insurance plans: Bronze, Silver, Gold, and Platinum. · Your total costs for health care: You pay a. Affordable Care Act. Marketplace Plan & Rate Information. The plan and rate View Plans & Premiums on 30h4.site Approved Rate Changes. Q5:Does the adult child have to purchase an individual policy? No. Eligible adult children wishing to take advantage of the coverage up to age 26 will be. If you have an individual or family plan that you personally purchased affordable health insurance through the Affordable Care Act (ACA). Can I get. Individual vs. family enrollment: Insurers can charge more for a Insurance companies can't charge women and men different prices for the same plan. In most states, those who make up to % of the federal poverty level qualify for Medicaid eligibility instead of ACA exchange subsidies. In , for a single. Use our updated calculator to see if you're eligible for Affordable Care Act (ACA) health insurance premium subsidies. Handsome young man in design office. Single, 25 years old. Denver County $35, annual income. Monthly premium Compare plans and prices. Before you shop.

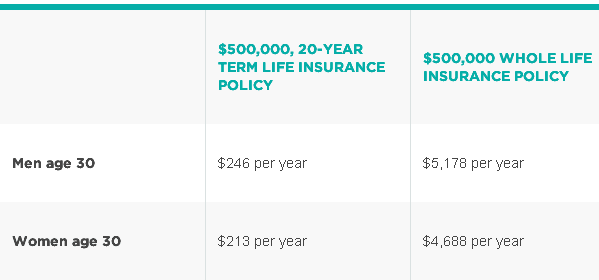

Average Whole Life Insurance Cost Per Month

1 The truth is the average cost of a term life insurance premium is around $ a year. term life insurance policy for less than $8/month. Even older. Life insurance calculator ; Death benefit, Payable if you pass away within the term period you select, Stays the same as long as you make payments ; Plan options. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. premiums. GET STARTED NOW Contact a financial professional. Life Insurance Calculator. How much life insurance do I need? I was born on. / Birth Month. / Birth. Once your premiums are set, what you pay each month (or yearly) will never go up Accumulates cash value. Your policy accumulates. Protect your loved ones with whole life insurance. It's a lifelong policy with premiums that remain the same and it includes living benefits like cash value. On average, you can expect to pay $83 per month for a $1 million, year term life insurance policy if you're a year-old woman who doesn't smoke. If you're. How Much Does Whole Life Insurance Cost? ; $, Coverage, Average Monthly Cost, Male, Average Monthly Cost, Female ; 30, $, $ ; 40, $, $ ; 50, $ If so, your hobbies may cause you to receive higher rates than the average consumer. life insurance to whole life during a time period spelled out in your. 1 The truth is the average cost of a term life insurance premium is around $ a year. term life insurance policy for less than $8/month. Even older. Life insurance calculator ; Death benefit, Payable if you pass away within the term period you select, Stays the same as long as you make payments ; Plan options. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. premiums. GET STARTED NOW Contact a financial professional. Life Insurance Calculator. How much life insurance do I need? I was born on. / Birth Month. / Birth. Once your premiums are set, what you pay each month (or yearly) will never go up Accumulates cash value. Your policy accumulates. Protect your loved ones with whole life insurance. It's a lifelong policy with premiums that remain the same and it includes living benefits like cash value. On average, you can expect to pay $83 per month for a $1 million, year term life insurance policy if you're a year-old woman who doesn't smoke. If you're. How Much Does Whole Life Insurance Cost? ; $, Coverage, Average Monthly Cost, Male, Average Monthly Cost, Female ; 30, $, $ ; 40, $, $ ; 50, $ If so, your hobbies may cause you to receive higher rates than the average consumer. life insurance to whole life during a time period spelled out in your.

State Farm Whole Life insurance policies offer level premiums and life insurance protection for as long as you live. Average monthly term life insurance rates ; $ $ ; $ $ ; $ $ ; $ $ The following life insurance calculator and tools will help you decide Term Life Insurance Quote Tool, Estimate how much coverage you may need to. Take our quick 8-question assessment for an approximate coverage level you'd need to care for your loved ones, help protect the things you value, and help meet. A healthy, year-old woman can expect an average monthly rate of $ A healthy, year-old man can expect an average monthly rate of $ A whole life policy can help your family cover your final expenses, including funeral costs, with a lump sum cash payment. Available for around $28/month. But term life insurance is dirt cheap, especially at your age, while whole life insurance is extremely expensive. The premiums for a whole life. You'll pay for your life insurance policy in monthly premiums: the amount you pay every month to have your life insurance coverage. You may also have the option. A year-old non-smoker would pay a $ monthly premium for the same policy.* By purchasing this policy at age 35 instead of 45, you could save $ per year. According to the IRS Premium Table, the cost per thousand is The employer pays the full cost of the insurance. If at least one employee is charged more. The average cost of life insurance largely depends on your risk of When considering coverage, you might wonder how much life insurance is per month. Average cost of a $1 million life insurance policy ; 30, $30, $24 ; 40, $49, $41 ; 50, $, $96 ; 60, $, $ Occupation: Your job matters when it comes to life insurance rates. If your job has a higher rate of risk than a typical office occupation, you may fall into a. USAA Simplified Whole Life Insurance provides lifetime coverage and benefits while building cash value over time. Learn more here or get a quote today. Whole life policies stretch the cost of insurance over a longer period of premiums per $1, of insurance than larger size regular insurance policies. Whole Life Insurance Rates Chart ; 40, $, $ ; 45, $, $ ; 50, $, $ ; 55, $, $ Whether you're researching term life insurance or whole life insurance quotes to determine what's best for you, GEICO can help online or by phone at () Whole life policies will cost more than other life insurance policies at about $3, to $5, or more annually depending on the age and health of the insured. State Farm Whole Life insurance policies offer level premiums and life insurance protection for as long as you live. While a calculator can help you estimate life insurance levels and costs, you may still want to work with a licensed agent or financial planner to ensure that.

Christys Auction House

Christie's original content brings you art and culture from around the world. Our stories inspire, educate, and resonate. Subscribe to discover rare objects. Unable to choose whether to consign the trove to Sotheby's or Christie's, company president Takashi Hashiyama put the decision in the auction houses' hands. The leading online auction platform. Search Christy's of Indiana Inc for the latest estate sales, estate auctions, online auctions, real estate auctions and. Christie's is an auction house. Sometimes estates come up for sale such as Elizabeth's Taylor's estate and you can view all the items that will be auctioned off. About Christie's. Information provided by various external sources. Christie's is a British auction house. It was founded in by James Christie. Contact. Christys of Indiana. We conduct a weekly auctions on Wednesday's selling with 6 auction MEM Auction House. Indianapolis, IN, USA. Find on the map. View. 1M Followers, Following, Posts - Christie's (@christiesinc) on Instagram: "Art, inspiration, and news from the world's leading auction house. Christie's selected NovaFori to build highly reliable and scalable auction house software that would permit Christie's to conduct multiple and simultaneous. Christie's offers around auctions annually in over 80 categories, including all areas of fine and decorative arts, jewellery, photographs, collectibles. Christie's original content brings you art and culture from around the world. Our stories inspire, educate, and resonate. Subscribe to discover rare objects. Unable to choose whether to consign the trove to Sotheby's or Christie's, company president Takashi Hashiyama put the decision in the auction houses' hands. The leading online auction platform. Search Christy's of Indiana Inc for the latest estate sales, estate auctions, online auctions, real estate auctions and. Christie's is an auction house. Sometimes estates come up for sale such as Elizabeth's Taylor's estate and you can view all the items that will be auctioned off. About Christie's. Information provided by various external sources. Christie's is a British auction house. It was founded in by James Christie. Contact. Christys of Indiana. We conduct a weekly auctions on Wednesday's selling with 6 auction MEM Auction House. Indianapolis, IN, USA. Find on the map. View. 1M Followers, Following, Posts - Christie's (@christiesinc) on Instagram: "Art, inspiration, and news from the world's leading auction house. Christie's selected NovaFori to build highly reliable and scalable auction house software that would permit Christie's to conduct multiple and simultaneous. Christie's offers around auctions annually in over 80 categories, including all areas of fine and decorative arts, jewellery, photographs, collectibles.

Christy's of Indiana is a family operated, full service, license auction gallery, founded in

Christie's Inc operates as an art auction house. The Company offers various products including fine and decorative arts, jewelry, photographs, wine, cars. Auction house · Business Info · Recommendations · Our story · Similar Businesses · Mascari Auctions · All American Auction Service · Key Auctioneers. WOOD CHRISTIE'S INTERNATIONAL REAL ESTATE LEVERAGES ITS CONNECTION TO THE ICONIC AUCTION HOUSE TO BENEFIT OUR CLIENTS IN A NUMBER OF WAYS. The Global. Browse upcoming auctions from Christys Auction Service in Laplata,MO on AuctionZip today. View full listings, live and online auctions, photos, and more. Christie's is a British auction house founded in by James Christie. Its main premises are on King Street, St James's in London. The Hong Kong Magnificent Jewels sale, which had originally been slated for June 2, signals a return to some normalcy for the famous auction house. Christie's. The leading online auction platform. Search Christy's of Indiana Inc for the latest estate sales, estate auctions, online auctions, real estate auctions and. It also is the only international auction house authorized to hold sales in mainland China (Shanghai). Christie's auctions span more than 80 art and luxury. Christie's New York is located at 20 Rockefeller Plaza Midtown - New York, NY, USA Contact the venue using this form or via phone: + A & B Auction & Flea Market. Michigan City, IN A To Z Auction House. Martinsville, IN Art collectors around the globe have the utmost respect for this renowned auction house, which was founded in 18th-century London and has bustling showrooms. Christie's is the most prestigious and highest-grossing art auction house in the world today. It's two centuries older than the famed Heritage Auctions and. Locations · 8 King Street. London, England SW1Y 6QT, GB · 20 Rockefeller Plaza. New York, NY, US · 22nd Floor, Alexandra House. 18 Chater Road Central · 1st Floor. auctioneer to acquire title to the goods in order to resell them. Auctions can be private or public, on-site or transported to Christys' Auction Gallery. Renowned and trusted for its expert live and online auctions DIRECTIONS. NE 39th St. MIAMI, FL () OTHER. DACRA · BRIDGE HOUSE EVENTS. Auction House Directory. Christie's. Christie's. Follow 3, Followers. About Auctioneer. Christie's is a name and place that speaks of extraordinary. Check out the event calendar for Christie's Auction house in NYC, along with artist, ticket and venue information, photos, videos, and address. BIRDCAGES / HOUSES · CANDELABRAS / CANDLESTICKS · CLOCKS · GLOBES / ARMILLARY auction facility in London, with the caveat that they would only be selling. A major attraction on 5th Avenue NYC Christies Auction House where you can see the greatest auctions from the 18th - 19th centuries. Christy's Auctions. Business Management. Mr. Jack Christy, Owner. Contact When considering complaint information, please take into account the company's.

Lost 6 Pounds In A Month

6. Eating plenty of fiber. Dietary fiber describes plant-based To lose 20 pounds in a month, people must burn more calories than they take. Dieticians advise that if you eat calories less than your daily requirement you will lose about 1lb every seven days (expect some variation from person to. Losing 6 lbs a month can be a sustainable rate of weight loss, especially if it's achieved through a combination of healthy eating and regular. The maximum amount of weight you can lose in one month is about 20 pounds, or 5 pounds per week. pm (or another 8-hour window of time). Another. Vegetables are not calorically dense, so it is critical that you add legumes for caloric load. Some athletes eat 6–8x per day to break up. What are some safe ways to lose 25 pounds in 6 months? · Eat at a moderate calorie deficit · Get adequate protein · Resistance training (structured program). Based on the information from NHS, it is healthy to lose pounds per week, which equals to pounds per month. Losing six pounds in two weeks can be painful, daunting, or really expensive. Keep your end results in mind and stick to the plan you choose. Advertisement. It's best to aim for losing 1 to 2 pounds per week. This is more likely to be a sustainable loss, especially if you achieve it by eating a balanced diet and. 6. Eating plenty of fiber. Dietary fiber describes plant-based To lose 20 pounds in a month, people must burn more calories than they take. Dieticians advise that if you eat calories less than your daily requirement you will lose about 1lb every seven days (expect some variation from person to. Losing 6 lbs a month can be a sustainable rate of weight loss, especially if it's achieved through a combination of healthy eating and regular. The maximum amount of weight you can lose in one month is about 20 pounds, or 5 pounds per week. pm (or another 8-hour window of time). Another. Vegetables are not calorically dense, so it is critical that you add legumes for caloric load. Some athletes eat 6–8x per day to break up. What are some safe ways to lose 25 pounds in 6 months? · Eat at a moderate calorie deficit · Get adequate protein · Resistance training (structured program). Based on the information from NHS, it is healthy to lose pounds per week, which equals to pounds per month. Losing six pounds in two weeks can be painful, daunting, or really expensive. Keep your end results in mind and stick to the plan you choose. Advertisement. It's best to aim for losing 1 to 2 pounds per week. This is more likely to be a sustainable loss, especially if you achieve it by eating a balanced diet and.

By reducing your daily caloric intake by , calories, you'll lose pounds per week, depending on your weight and how much you currently eat. Combined. Some studies show that overweight or obese women who gain only 6 to 14 pounds had similar or better neonatal outcomes than women who gained the recommended Tips for losing weight Aim to lose between lb (kg) and 2lb (1kg) a week until you reach your target weight. A healthy, balanced diet and regular. Clinically trained dietitians and accredited nutrition experts agree, you don't want to lose more than 2 pounds in a week. “Any more aggressive than that, and. Unexplained weight loss, or losing weight without trying — particularly if it's significant or ongoing — may be a sign of a medical disorder. Unexplained weight loss is when you lose a significant amount of weight in a short amount of time ( months) and there doesn't seem to be a reason for it. There are legit reasons why you have a hard time shedding those extra pounds, but if you know the facts about losing weight, you can overcome these obstacles. Shedding excess pounds through proper diet and exercise If an elderly loved one has unintentionally lost 5% or more of their body weight over a 6-month. A good rule of thumb is to aim to lose 1–2 pounds per week or 4–8 pounds per month, says Dr. Elizabeth Lowden, a bariatric endocrinologist. Losing no more than 1/2 to 2 pounds per week is recommended. Incorporating long-term lifestyle changes are needed to increase the chance of successful long. To lose 5 pounds in a month, for example, perform physical activity that burns an additional calories daily and eat calories less that what's needed to. Weight loss should be about 1 to 2 pounds per week for a period of 6 months, with the subsequent strategy based on the amount of weight lost. Low-calorie. Losing 5 pounds a week comes to reducing your food intake by calories over seven days. The value that represents the decrease in calorie intake is known as. pounds while 10% would be 15 pounds. So, if they unintentionally lost pounds within a month or 15 pounds within six months, it might be concerning. “As. I ate this everyday for 1 week and LOST 6 Pounds. 48K views · 9 months ago #mealplan #portioncontrol #weightlossjourney more. Nicole Collet. On average, new moms lose around 13 pounds (6 kg) due to the baby's weight, the amniotic fluid, and the placenta when giving birth. The week after you deliver. Indeed, there are studies that say that for seniors, having a few extra pounds is actually healthy and can be beneficial if facing chemo or a lingering illness. The sensible answer to losing excess body fat is to make small healthy changes to your eating and exercise habits. See a GP if: you keep losing weight without changing your diet or exercise routine. Treatment for unintentional weight loss. Listening to your body is key when it comes to losing weight. Focusing on whole, real foods packed with protein, healthy fat, fiber and antioxidants is crucial.

Iar Investment Advisor

presumed to be acting as an IAR. ▫ Each IAR rendering investment advisory services on behalf of a registered investment adviser must first be registered in. Each investment adviser representative (IAR) providing investment advisory services to a Texas resident must also register. IARs must register with the firm. Each year, IARs will need to attain 12 CE credits to maintain their IAR registration. The 12 credits must include six credits of Products and Practice and six. Investment adviser representatives (IARs) are required to complete 12 credit hours of continuing education (CE) each year. A firm that qualifies as an exempt reporting adviser under SEC rules may still have NY registration requirements. An investment adviser with six (6) or more New. Many financial advisors are registered as both registered representatives of a broker-dealer and as investment-advisor representatives (IAR) of an investment. Investment adviser representatives (IARs) · Individual who represents a financial firm in offering securities advice · Also includes supervisors of IARs. Investment Advisers (IA) & Investment Adviser Representatives (IAR) · Investment Adviser (Firms only) · Representatives of Investment Advisers (Individuals). An investment adviser is an individual or company who is paid for providing advice about securities to their clients. The term investment adviser refers to. presumed to be acting as an IAR. ▫ Each IAR rendering investment advisory services on behalf of a registered investment adviser must first be registered in. Each investment adviser representative (IAR) providing investment advisory services to a Texas resident must also register. IARs must register with the firm. Each year, IARs will need to attain 12 CE credits to maintain their IAR registration. The 12 credits must include six credits of Products and Practice and six. Investment adviser representatives (IARs) are required to complete 12 credit hours of continuing education (CE) each year. A firm that qualifies as an exempt reporting adviser under SEC rules may still have NY registration requirements. An investment adviser with six (6) or more New. Many financial advisors are registered as both registered representatives of a broker-dealer and as investment-advisor representatives (IAR) of an investment. Investment adviser representatives (IARs) · Individual who represents a financial firm in offering securities advice · Also includes supervisors of IARs. Investment Advisers (IA) & Investment Adviser Representatives (IAR) · Investment Adviser (Firms only) · Representatives of Investment Advisers (Individuals). An investment adviser is an individual or company who is paid for providing advice about securities to their clients. The term investment adviser refers to.

Investment Adviser Reps (IARs) – Individuals who offer investment advice including financial planning services. With whom do investment advisers and investment. IARD is an electronic filing system that facilitates investment adviser registration, exempt reporting adviser filing, regulatory review, and the public. SCIAs that are licensed in the District of Columbia must obtain an Investment Adviser Representative (IAR) License for each employee or other person that. Employ at least one investment adviser representative (IAR) that is licensed under the Oregon securities laws (starting at Oregon). Firms regulated by the. The IAR is the individual advisor(s) underneath the RIA that formally deliver the advice. There are specific regulatory processes associated with the creation. An investment adviser is an individual or a firm that is in the business of giving advice about securities to clients. Investment advisors wanting to do. Note: Investment adviser representatives (IAR) who work for a Federal covered adviser, must register if the IAR has a "place of business" in South Dakota. Please note that Investment Advisers with custody over client funds, but not solely due to direct fee deduction or advising pooled investments, must maintain a. The most common path to becoming an independent investment advisor is to first work as an investment adviser representative (IAR) at another firm. Investment Adviser Firms or Professionals · have between $25 million and $ million under management and are required to be registered in 15 or more states;. The SEC does not license or register IARs to register at the federal level. IA and IAR Licensing Overview. Both an application and a fee are required in order. An IAR an individual who works for a RIA firm and has passed the necessary licensing requirements to offer investment advice. So while the two terms and their. IAPD provides information on Investment Adviser firms regulated by the SEC and/or state securities regulators. How does the IAR CE Status impact an IAR Registration Status and what does each status mean? If you have additional questions, please visit NASAA's IAR CE. Yes, associated persons of an SEC registered investment advisor firm that fall within the SEC and the applicable state's definition of an IAR are required to. The IAR is subject to registration in Florida only (no Alabama registration required). Keep in mind this is drastically different* than agents and IARs of state. Registration of Investment Advisers The term “investment adviser” includes financial planners and firms or individuals that advertise, hold themselves out as. Examination Requirements: Michigan Investment Adviser Representative (“IAR”) registration requires either the Series 65 examination, or the combination of a. RegEd is an authorized provider of Investment Adviser Representative Continuing Education (IAR CE) courses for registered IARs in accordance with the NASAA. The Illinois Securities Department offers free information to consumers to assist in reviewing the qualifications of an investment adviser representative. To.

Annuitant Meaning

Annuitant definition: a person who receives an annuity.. See examples of ANNUITANT used in a sentence. An annuitant is an individual who receives payments from an annuity. An annuity is used as a means of securing a steady income stream during retirement. Definition of an Affected Annuitant: Sec of the Illinois Pension Code defines annuitant as "A person receiving a retirement, reversionary, survivors. annuitant” or your “optionee.” You might choose, for example, to have your contingent annuitant receive a lifetime benefit after your death that is equal to. An annuitant is an individual who receives benefits from an annuity. An annuity is a financial product that provides a steady stream of income to the. Annuitant is an individual named in the contract who is entitled to receive the income benefits from the annuity. Annuitants may change plans, options, or type of enrollment when they have a change in family status under the same conditions as an active employee (but an. annuitant” or your “optionee.” You might choose, for example, to have your contingent annuitant receive a lifetime benefit after your death that is equal to. An annuitant is a person who is entitled to receive benefits from an annuity. The payout benefits for an annuitant are based on the person's life expectancy. Annuitant definition: a person who receives an annuity.. See examples of ANNUITANT used in a sentence. An annuitant is an individual who receives payments from an annuity. An annuity is used as a means of securing a steady income stream during retirement. Definition of an Affected Annuitant: Sec of the Illinois Pension Code defines annuitant as "A person receiving a retirement, reversionary, survivors. annuitant” or your “optionee.” You might choose, for example, to have your contingent annuitant receive a lifetime benefit after your death that is equal to. An annuitant is an individual who receives benefits from an annuity. An annuity is a financial product that provides a steady stream of income to the. Annuitant is an individual named in the contract who is entitled to receive the income benefits from the annuity. Annuitants may change plans, options, or type of enrollment when they have a change in family status under the same conditions as an active employee (but an. annuitant” or your “optionee.” You might choose, for example, to have your contingent annuitant receive a lifetime benefit after your death that is equal to. An annuitant is a person who is entitled to receive benefits from an annuity. The payout benefits for an annuitant are based on the person's life expectancy.

Where does the word annuitant come from? The earliest known use of the word annuitant is in the early s. OED's earliest evidence for annuitant is from. RAs are to be temporary in nature. The proper use of a RA, as defined by CalHR, is as follows: To mentor new employees; To transfer knowledge. Annuitant Sentence Examples · This means the annuitant would need to be over 70 years of age given the current rate of annuity interest. · It assumes the. annuitant. (2) Annuitant.— The term “annuitant” means— (A) any individual who would satisfy the requirements of paragraph (3) of section if, for. the recipient of an annuity. see moresee less. type of: receiver, recipient. a person who receives something. Cite this entry. Joint annuitants can be named in annuity contracts, often chosen by married couples for shared income. Joint and survivor annuities provide income for both. Define Annuitant. means a person who receives a retirement allowance or a disability allowance;. annuity may have a new schedule for charges that could mean new expenses you must pay directly or indirectly. annuitant remains alive; the payment amount may. An annuitant is an individual who receives payments from an annuity. An annuity is used as a means of securing a steady income stream during retirement. annuitant. (2) Annuitant.— The term “annuitant” means— (A) any individual who would satisfy the requirements of paragraph (3) of section if, for. An annuitant is someone who is entitled to collect the regular payments of a pension or an annuity investment. An annuity is a contract that requires regular payments for more than one full year to the person entitled to receive the payments (annuitant). What is the definition of annuitant and how do they differ from the annuity owner? We break it down in this blog post. Joint annuitants can be named in annuity contracts, often chosen by married couples for shared income. Joint and survivor annuities provide income for both. If the retirement system does not meet that definition, then mandatory Social Security coverage would apply to the rehired annuitant. Medicare coverage. An 'annuitant' refers to the person on whose life an annuity contract is based. The annuitant is the individual who will receive the income payments from the. JOINT ANNUITANT INFORMATION. If you select Option 3 or Option 4 under the Florida Retirement System (FRS) Pension Plan, you must designate a beneficiary who. An annuitant is someone who invests in a pension plan or annuity and is entitled to receive regular payments from it. They are like a creditor, meaning they. Joint Annuitant refers to a second individual covered under an annuity, affecting payout options and duration. Understand its implications for retirement. • The annuitant is appointed as a justice or judge of the United. States, as defined by section of title 28 of the United States. Code; or. • The annuitant.

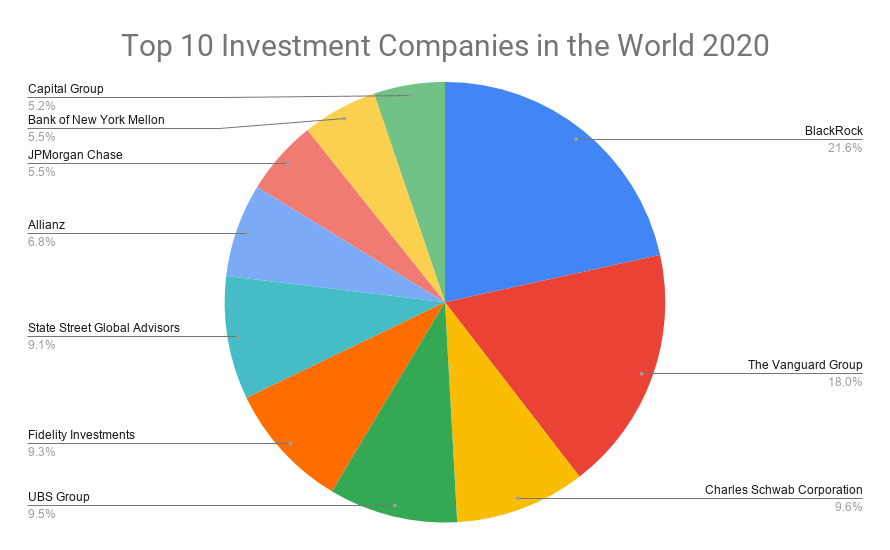

Top 10 Funds To Invest

See iA Financial Group's investment fund performance for our retirement savings, education savings and universal life insurance products. 10 yrs. IAG Savings and Retirement Plan (). ESG Funds. SRI Moderate (Inhance) IAG Savings and Retirement PlanClassic Series 75/75ESG FundsFUIND Below is a complete list of our 4 and 5-star funds by Morningstar. Recommending mutual funds to your clients just got easier. Most consistent funds consisting of Top 10 Mutual Fund Schemes in each category have been chosen based on average rolling returns and consistency. BEST MUTUAL FUNDS ; Bank of India Flexi Cap Fund Direct Growth · ₹ · ₹1, Cr ; JM Flexicap Fund (Direct) Growth Option · ₹ · ₹3, Cr ; Quant. Morningstar gives its best ratings of five or four stars to the top 33% of all funds (of the 33%, 10% get five stars and % get four stars) based on their. Prices and performance ; Sun Life MFS U.S. Growth Fund, A, CAD, $B ; Sun Life MFS U.S. Growth Fund, A, USD, $B. UOPSX. ProFunds UltraNASDAQ Fund, + ; UOPIX. ProFunds UltraNASDAQ Fund, + ; RYVYX. Rydex NASDAQ 2x Strategy H · + Top 10 most-popular investment funds in July ; 5, HSBC FTSE All-World Index, Global ; 6, Fidelity Index World P Acc (BJS8SJ3), Global ; 7, Vanguard. See iA Financial Group's investment fund performance for our retirement savings, education savings and universal life insurance products. 10 yrs. IAG Savings and Retirement Plan (). ESG Funds. SRI Moderate (Inhance) IAG Savings and Retirement PlanClassic Series 75/75ESG FundsFUIND Below is a complete list of our 4 and 5-star funds by Morningstar. Recommending mutual funds to your clients just got easier. Most consistent funds consisting of Top 10 Mutual Fund Schemes in each category have been chosen based on average rolling returns and consistency. BEST MUTUAL FUNDS ; Bank of India Flexi Cap Fund Direct Growth · ₹ · ₹1, Cr ; JM Flexicap Fund (Direct) Growth Option · ₹ · ₹3, Cr ; Quant. Morningstar gives its best ratings of five or four stars to the top 33% of all funds (of the 33%, 10% get five stars and % get four stars) based on their. Prices and performance ; Sun Life MFS U.S. Growth Fund, A, CAD, $B ; Sun Life MFS U.S. Growth Fund, A, USD, $B. UOPSX. ProFunds UltraNASDAQ Fund, + ; UOPIX. ProFunds UltraNASDAQ Fund, + ; RYVYX. Rydex NASDAQ 2x Strategy H · + Top 10 most-popular investment funds in July ; 5, HSBC FTSE All-World Index, Global ; 6, Fidelity Index World P Acc (BJS8SJ3), Global ; 7, Vanguard.

1. Citadel · 2. Bridgewater Associates · 3. AQR Capital Management · 4. D.E. Shaw · 5. Renaissance Technologies · 6. Two Sigma Investments · 7. Elliott Investment. 0PLTYL FSSA China All Cap III USD. + (+%). + ; 0PQRHP Principal Global Investors Funds-CCB Principal China New Energy Innovation Fund. Growth Funds are CIBC's mutual fund solution for investors looking for a higher potential return on their investment. Our pick for the best overall mutual fund is Fidelity Index Fund (FXAIX). With an expense ratio of just %, this fund ranks as one of the cheapest in. We provide a comprehensive range of mutual funds across all asset classes, sectors, geographies and themes to help you reach your investment goals. What is a mutual fund? 2. What do mutual funds invest in? 3. How can you make money? 4. What are the risks? 5. How is your investment protected? 6. What are the. Cumulative net income for year period. $ Billion. Cumulative net We pursue the best investment opportunities, wherever they are, to ensure. Top 10 most-popular investment funds in May ; 5, HSBC FTSE All-World Index, Global ; 6, Jupiter India I Acc (B4TZHH9), India / Indian Subcontinent ; 7. A list of Morningstar 5-star rated funds and ETFs offered by Mackenzie Investments. If a fund scores in the top 10% of its fund category, it gets 5 stars; if. ICICI Prudential Focused Bluechip Equity Fund · Aditya Birla Sun Life Small & Midcap Fund · Tata Equity PE Fund · HDFC Monthly Income Plan – MTP · L&T Tax Advantage. Explore our top-performing investment solutions. Offering a wide variety of fore star and five star investment solutions. Bandhan Infrastructure Fund · ₹1, Crs ; Nippon India Small Cap Fund · ₹60, Crs ; ICICI Prudential Infrastructure Fund · ₹6, Crs ; DSP T.I.G.E.R. Fund · ₹. List of Best SIP Funds in India sorted by Returns ; Quant Active Fund · ₹11, Crs ; Quant Large and Mid Cap Fund · ₹3, Crs ; Quant Focused Fund · ₹1, Crs. Investment funds currently most popular with Hargreaves Lansdown clients Top SIPP funds. Change view: Charges and savings | Prices and yields. Invest in funds that have received top ratings from a leader in independent investment research. Over 70 of our funds have earned 4- or 5-Star Overall. Our pick for the best overall mutual fund is Fidelity Index Fund (FXAIX). With an expense ratio of just %, this fund ranks as one of the cheapest in. (10/03/). $3K. $ $ (%). VCMDX. Commodity Strategy Fund Admiral Bond - Inter-term Investment. 2. %. Core Bond Fund Admiral Shares. Buy. Stock funds may vary depending on the fund's investment objective. Top 10 long and short positions - The top 10 holdings ranked by market value. (10/03/). $3K. $ $ (%). VCMDX. Commodity 5. %. Emerging Markets Select Stock Fund. Buy Vanguard Emerging Markets Select Stock Fund. Explore the top-performing mutual funds to invest in for Check out our Here is a glimpse of a fund's risk score. High, Top 10%. Above Average.

1 2 3 4 5